Your cash flow is crucial for maintaining the financial health of any business. It involves keeping track of the inflows and outflows of cash to ensure you have enough liquidity to meet your obligations. But how often should you review your cash flow? Let’s explore this topic in detail to help you manage your finances more effectively.

How Often is It Recommended to Review a Cash Flow Plan?

The frequency of reviewing your cash flow plan can significantly impact your financial stability. It is recommended to review your cash flow plan at least monthly.

This regular review allows you to identify trends, address potential issues before they become serious problems, and adjust your strategies accordingly. It helps you stay on top of any changes in your financial situation and ensures you are prepared for any unexpected expenses or revenue fluctuations.

The Importance of Monthly Reviews

The importance of conducting monthly reviews cannot be overstated. By reviewing your cash flow on a monthly basis, you gain insights into your spending patterns, revenue generation, and overall financial health.

This frequent check-up helps you manage your budget more effectively, make timely decisions, and prevent cash flow crisis. It also allows you to forecast future cash needs and make informed decisions about investments or cost-cutting measures.

How Often Should Cash Flow Be Updated?

Cash flow should be updated regularly to reflect the most current financial data. It is advisable to update your cash flow projections weekly, especially in dynamic business environments.

Weekly updates ensure that you are incorporating the latest information about sales, expenses, and other financial activities. This frequent updating helps you respond quickly to changes and maintain a more accurate view of your financial position.

The Benefits of Weekly Updates

The benefits of updating your cash flow on a weekly basis include better financial control and improved forecasting accuracy. Weekly updates help you track short-term cash flow variations.

It makes necessary adjustments to avoid potential liquidity issues. It also allows you to spot trends early and respond proactively, ensuring you are always prepared for any financial challenges that may arise.

How Often Should You Review Your P&L?

The Profit and Loss (P&L) statement, also known as the income statement, provides a summary of your revenues, costs, and expenses over a specific period.

It is essential to review your P&L statement monthly to understand your business’s profitability and operational efficiency. Regular reviews of your P&L statement help you identify areas where costs can be reduced, revenues can be increased, and overall financial performance can be improved.

Monthly P&L Reviews for Financial Health

The monthly review of your P&L statement plays a critical role in maintaining financial health. It enables you to track performance against your budget, analyse variances

It makes necessary adjustments to improve profitability. Monthly reviews also help you stay on top of your financial goals and ensure that your business is on the right track toward achieving long-term success.

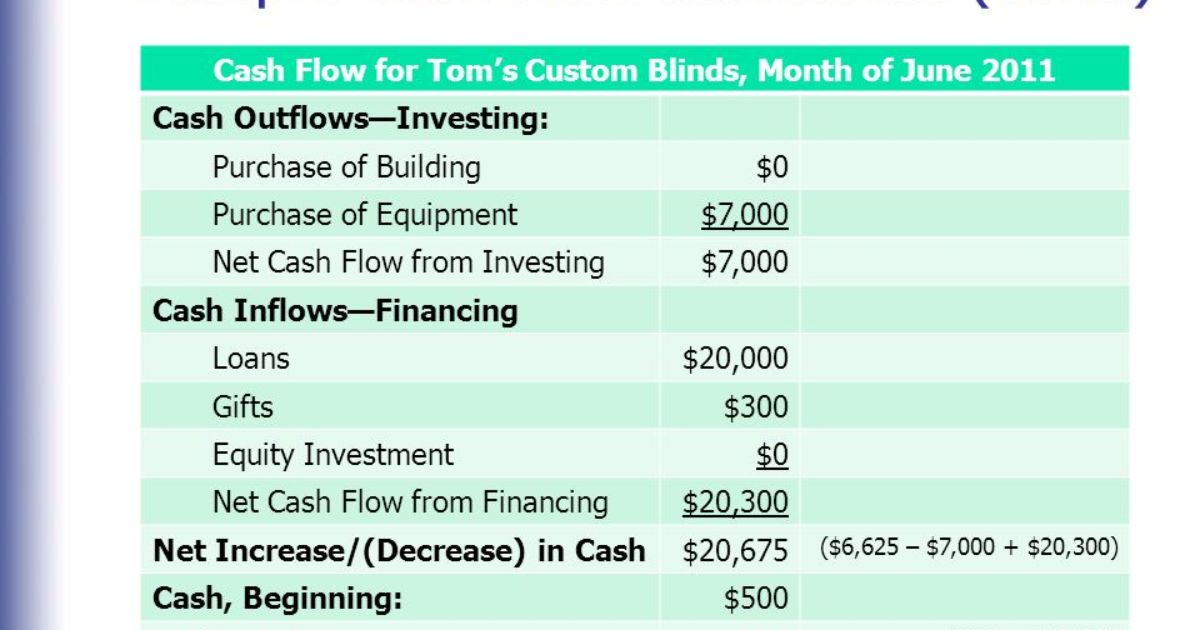

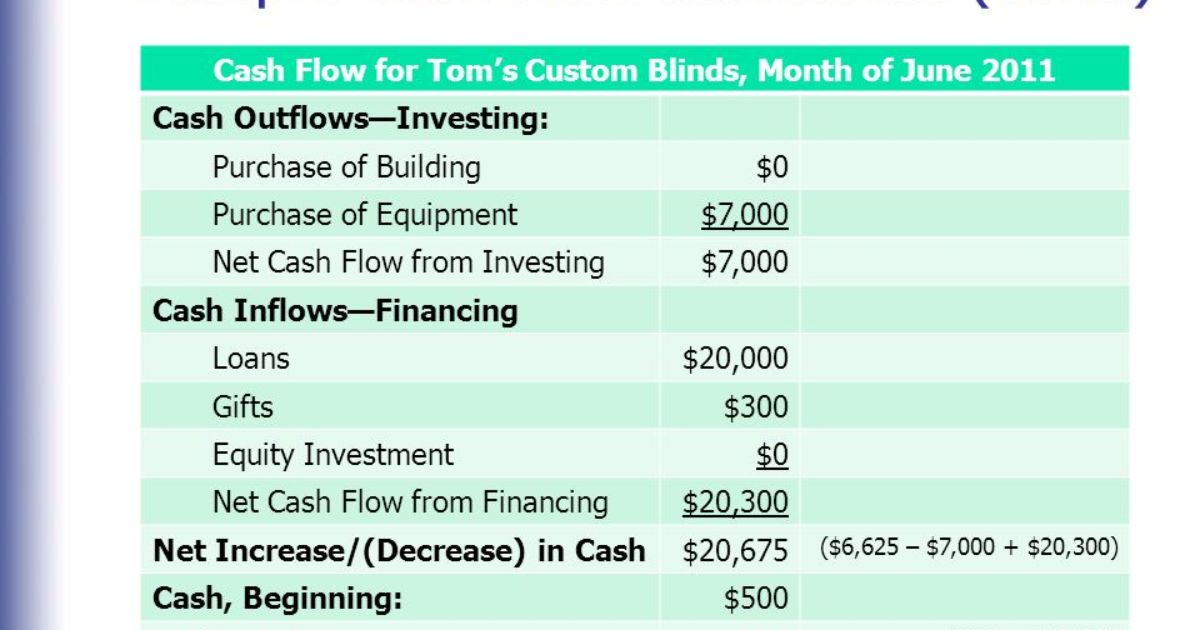

How Often Do You Prepare a Cash Flow Statement?

The preparation of a cash flow statement is typically done on a monthly basis. This frequency ensures that you have a clear and up-to-date picture of your cash flow activities.

Monthly preparation of the cash flow statement allows you to monitor your cash inflows and outflows, assess your liquidity position, and make informed decisions about cash management.

The Role of Monthly Cash Flow Statements

The role of preparing cash flow statements monthly is crucial for effective cash management. It helps you track cash movements, analyze cash flow patterns, and make timely adjustments to improve liquidity. Monthly cash flow statements also provide valuable insights for financial planning and decision-making, enabling you to manage your resources more efficiently.

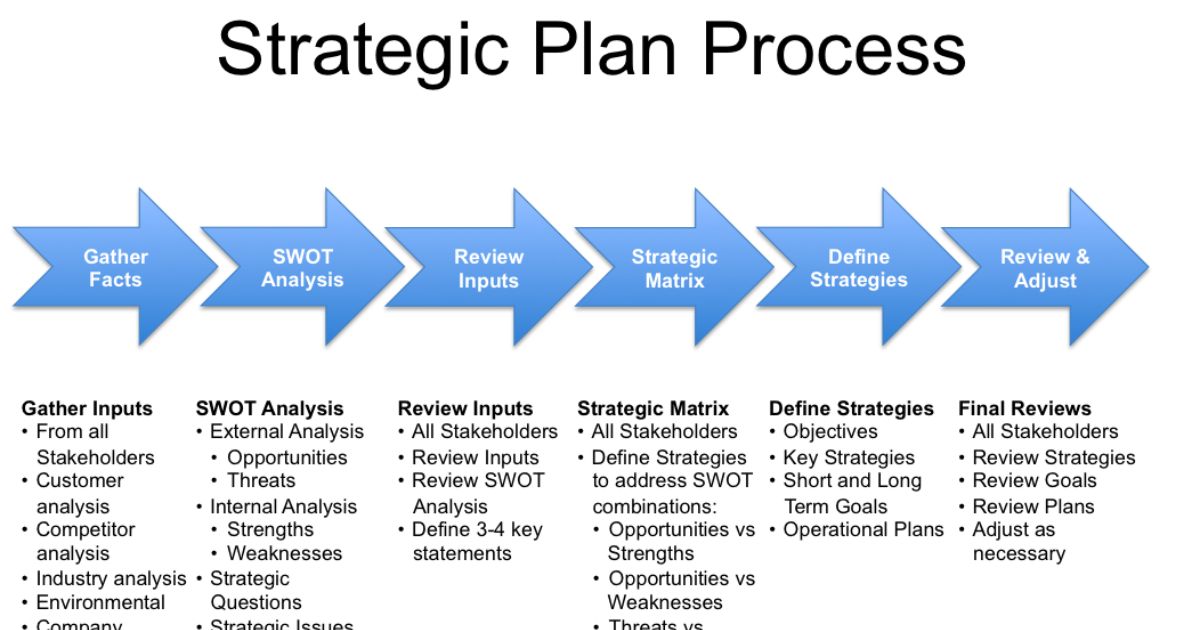

The Impact of Cash Flow Reviews on Business Strategy

The impact of regular cash flow reviews on your business strategy is significant. By frequently reviewing your cash flow, you can align your financial strategies with your business goals.

It makes data-driven decisions, and optimises resource allocation. Regular cash flow assessments help you identify opportunities for growth, manage risks, and enhance overall financial performance.

Adjusting Your Business Strategy Based on Cash Flow Insights

Adjusting your business strategy based on cash flow insights allows you to respond to changing financial conditions and market dynamics. It helps you make informed decisions about pricing, cost management, and investment opportunities.

Regular cash flow reviews provide the information needed to adapt your strategy and stay competitive in a rapidly changing business environment.

The Risks of Infrequent Cash Flow Reviews

The risks of infrequent cash flow reviews include potential cash shortages, missed opportunities, and financial instability. Without regular reviews, you may not detect cash flow problems until they escalate, leading to significant financial challenges. Infrequent reviews also limit your ability to forecast accurately and make timely adjustments to your financial strategies.

Strategies for Effective Cash Flow Management

Strategies for effective cash flow management involve regular monitoring, forecasting, and optimization. Implementing a robust cash flow management system.

It helps you track and manage cash movements, forecast future cash needs, and make informed financial decisions. Utilising tools and technologies for cash flow management can enhance accuracy and efficiency in managing your finances.

Leveraging Technology for Cash Flow Reviews

Leveraging technology for cash flow reviews can streamline the process and improve accuracy. Financial software and tools can automate cash flow tracking, generate reports, and provide real-time insights into your financial data. Using technology effectively helps you stay organized, make data-driven decisions, and maintain a clear understanding of your cash flow position.

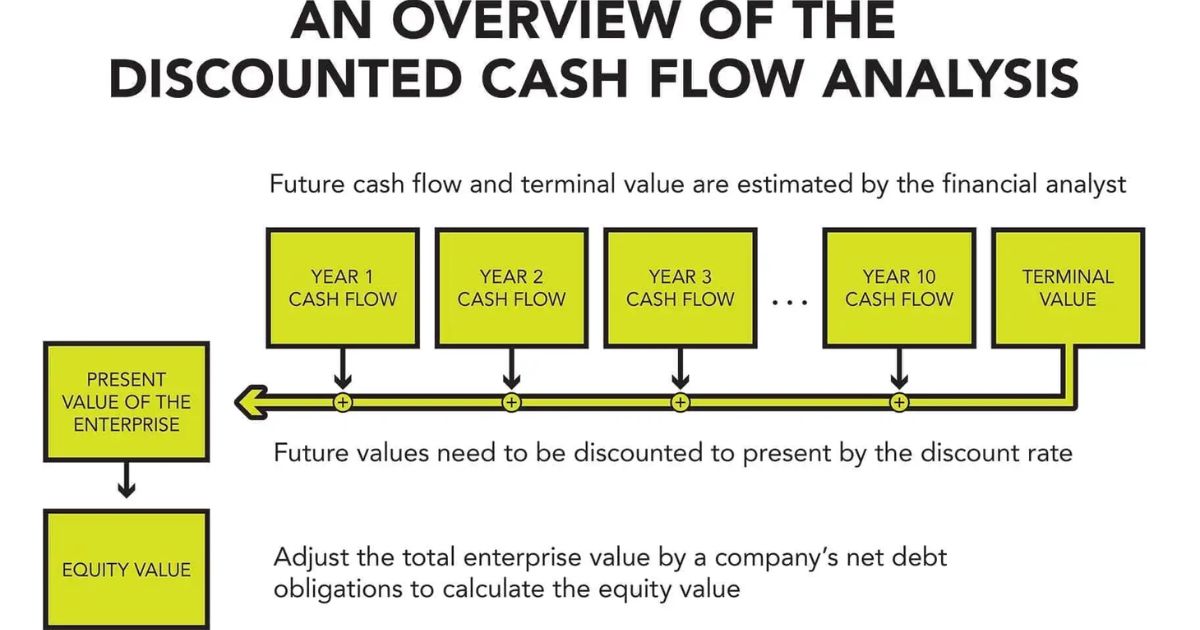

The Role of Forecasting in Cash Flow Management

The role of forecasting in you cash flow management is to predict future cash needs and ensure adequate liquidity. Accurate forecasting helps you anticipate cash flow fluctuations.

It plans for seasonal variations, and prepares for unexpected expenses. By incorporating forecasting into your cash flow management practices, you can enhance financial stability and support business growth.

The Benefits of Regular Financial Reviews

The benefits of regular financial reviews extend beyond cash flow management. They include improved financial visibility, better decision-making, and enhanced strategic planning.

Regular reviews of cash flow, P&L statements, and other financial metrics help you stay on top of your business’s financial health and ensure that you are on track to achieve your goals.

Frequently Asked Questions

1. How often should I review my cash flow plan?

It is recommended to review your cash flow plan at least monthly. This frequent review helps you stay on top of financial changes, identify trends, and make necessary adjustments to maintain financial stability.

2. How often should I update my cash flow projections?

Updating your cash flow projections weekly is advisable, especially in a dynamic business environment. Weekly updates allow you to incorporate the latest financial data and respond promptly to changes.

3. How often should I review my P&L statement?

You should review your P&L statement monthly to monitor profitability, analyze expenses, and make informed decisions to improve financial performance.

4. How often should I prepare a cash flow statement?

Preparing a cash flow statement monthly is recommended to maintain an accurate view of your cash inflows and outflows and ensure effective cash management.

Conclusion

The frequency of reviewing and updating your cash flow and financial statements plays a vital role in managing your business’s financial health. Regular reviews, whether monthly or weekly, provide valuable insights into your cash flow, profitability, and overall financial position. By staying proactive and leveraging technology for financial management, you can ensure that your business remains financially stable and poised for growth.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.