Understanding financial statements is crucial for anyone involved in managing finances, whether you’re a business owner, investor, or student. One of the key financial documents is the cash flow statement. This article will explore what a cash flow statement is, its importance, and how it compares to other financial statements.

What is the Cash Flow Statement in Simple Terms?

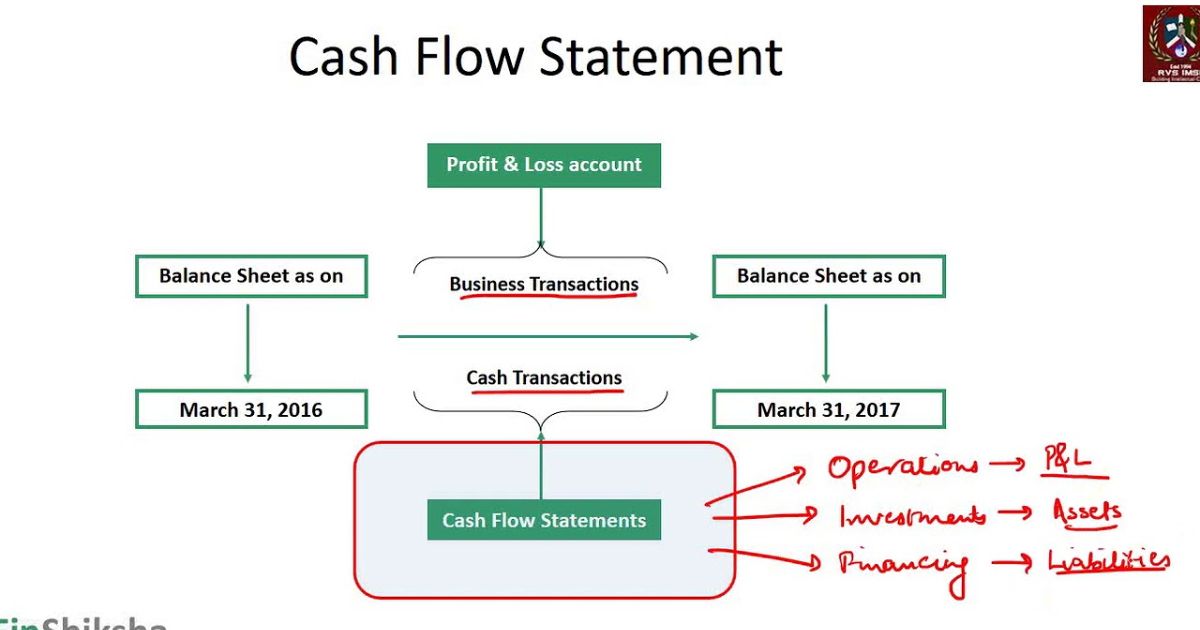

The cash flow statement is a financial document that provides a detailed breakdown of a company’s cash inflows and outflows over a specific period.

It shows how cash moves in and out of the business, focusing on the operational, investing, and financing activities. The primary purpose of this statement is to give stakeholders a clear picture of how a company manages its cash, which is crucial for assessing its financial health.

Understanding the Components of a Cash Flow Statement

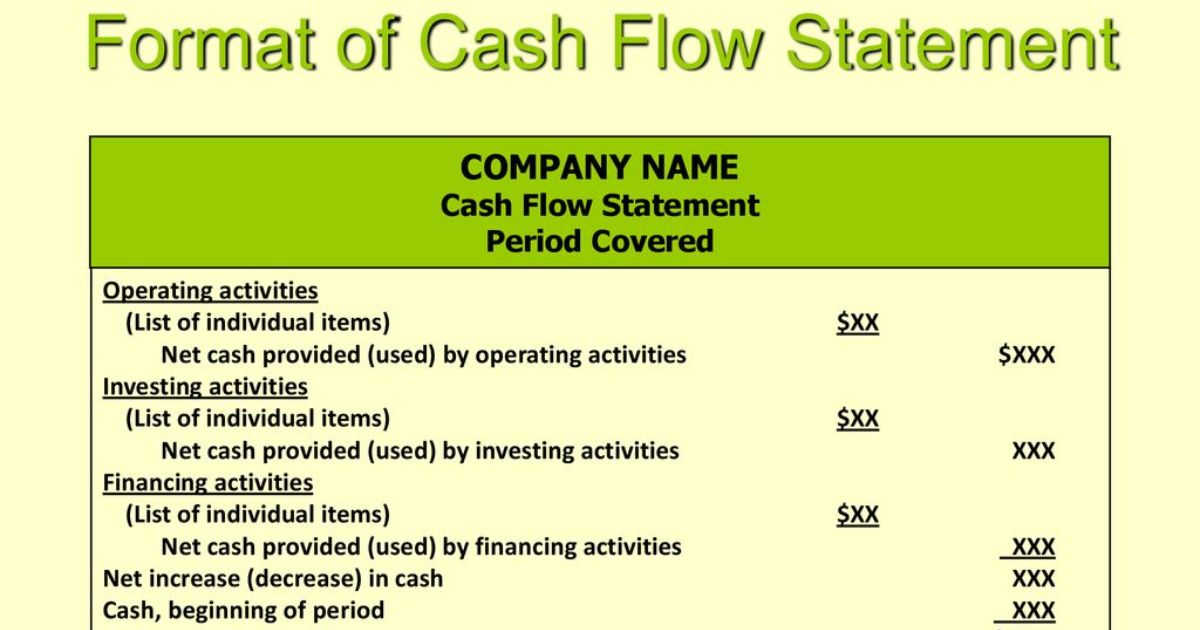

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. The operating activities section shows cash generated or used in the core business operations.

Investing activities include cash flows from buying or selling assets like property or equipment. Financing activities involve cash flows related to borrowing, repaying debt, or issuing shares.

What is the Difference Between a Balance Sheet and a Cash Flow Statement?

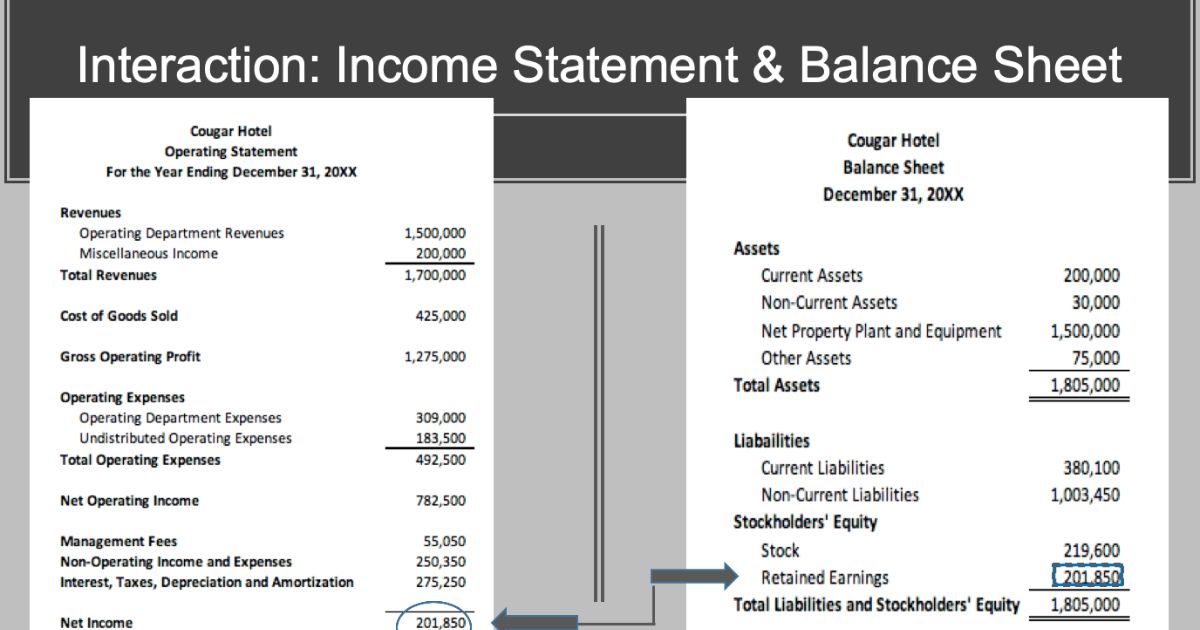

The balance sheet and cash flow statement are both essential financial statements but serve different purposes. The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It shows what the company owns and owes.

In contrast, the cash flow statement focuses on cash movements over a period, providing insights into how cash is generated and spent. While the balance sheet reflects the company’s financial position, the cash flow statement reveals its liquidity and operational efficiency.

What is an Example of a Cash Flow?

An example of a cash flow is the cash received from sales of goods or services. This inflow is recorded under operating activities and demonstrates how the company generates cash through its core business operations.

Conversely, an outflow example is cash paid for purchasing inventory or equipment, which is recorded under investing or operating activities depending on the nature of the expenditure.

The Significance of the Cash Flow Statement

The cash flow statement is significant because it provides crucial information about a company’s ability to generate cash and manage its liquidity.

It helps investors and creditors assess whether the company can meet its short-term obligations and fund its operations without relying on external financing. Additionally, it offers insights into how well the company can sustain and grow its business.

How Does a Cash Flow Statement Benefit Investors?

The cash flow statement benefits investors by giving them a clear view of the company’s cash management practices. It helps them evaluate the company’s ability to generate cash from its operations, which is critical for sustaining growth and paying dividends. Investors use this information to make informed decisions about buying, holding, or selling shares.

The Role of Operating Activities in Cash Flow Statements

Operating activities form a crucial part of the cash flow statement. They include cash transactions related to the core business operations, such as sales revenue and payments to suppliers. This section helps assess how efficiently a company generates cash from its primary business activities and indicates its operational health.

The Impact of Investing Activities on Cash Flow

Investing activities involve cash flows from transactions related to the acquisition or disposal of long-term assets. This section can impact cash flow significantly, as it reflects investments in growth opportunities or the sale of assets. Positive cash flows from investing activities can indicate the company’s potential for future growth, while negative cash flows might suggest significant investment in business expansion.

How Financing Activities Affect Cash Flow

Financing activities include cash flows related to obtaining or repaying capital. This section covers transactions such as issuing new shares, borrowing, or repaying debt.

The cash flow statement reveals whether a company is raising capital to fund operations or returning value to shareholders through dividends and share buybacks.

Comparing Cash Flow Statements with Income Statements

The cash flow statement and income statement serve different purposes. The income statement shows the company’s revenues, expenses, and profits over a period, providing insights into profitability.

In contrast, the cash flow statement focuses on actual cash movements, which might differ from the profits reported on the income statement due to non-cash transactions and adjustments.

How to Analyze Cash Flow Statements for Better Decision Making

To analyse cash flow statements effectively, look at the cash flows from operating activities to gauge the company’s core business efficiency. Examine investing activities to understand how the company is investing in growth or managing assets.

Assess financing activities to see how the company is funding its operations and returning value to shareholders. Combining these insights provides a comprehensive view of the company’s financial health and stability.

Common Misconceptions About Cash Flow Statements

A common misconception is that a positive cash flow always indicates a healthy company. While positive cash flow is important, it’s essential to analyse it in context.

For instance, a company might have positive cash flow due to selling assets or taking on debt, which might not be sustainable long-term. Similarly, negative cash flow isn’t necessarily a bad sign if it results from significant investments in future growth.

The Relationship Between Cash Flow and Profitability

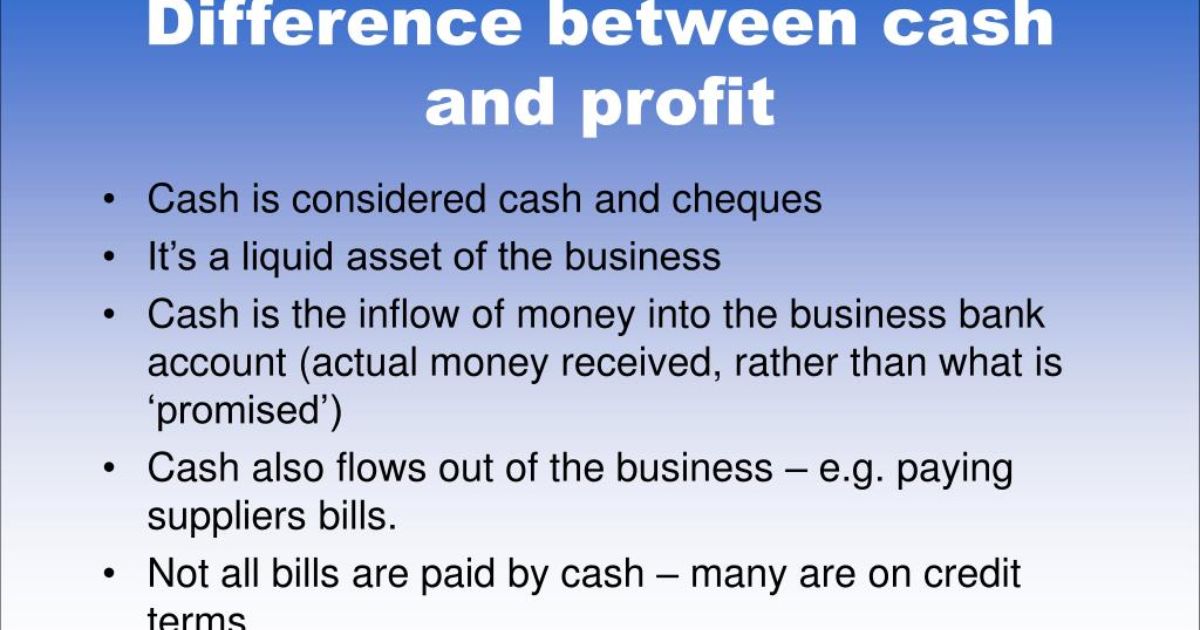

The relationship between cash flow and profitability is intricate. While profitability indicates a company’s ability to generate earnings, cash flow reflects its ability to convert those earnings into actual cash.

A company might show profits but face cash flow issues if earnings are tied up in receivables or inventory. Analysing both statements provides a fuller picture of financial performance.

The Importance of Cash Flow Management for Small Businesses

For small businesses, effective cash flow management is crucial for survival and growth. Unlike large corporations, small businesses often have limited cash reserves and face higher financial risks.

Monitoring cash flow helps small business owners ensure they have enough liquidity to cover expenses, invest in opportunities, and navigate financial challenges.

The Future of Cash Flow Statement Reporting

As technology evolves, cash flow statement reporting is becoming more sophisticated. Advances in financial software and analytics tools allow for more detailed and real-time cash flow analysis.

These tools help businesses and investors make more informed decisions by providing deeper insights into cash flow patterns and trends.

Frequently Asked Questions

Q1. What is the cash flow statement in simple terms?

The cash flow statement is a financial document that details how cash is generated and used in a business over a specific period.

Q2. What is the difference between a balance sheet and a cash flow statement?

The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time, showing its financial position.

Q3. What is an example of a cash flow?

An example of a cash flow is cash received from sales of products or services, which is recorded under operating activities.

Q4. What is the significance of the cash flow statement?

The cash flow statement is significant because it helps assess a company’s ability to generate cash, manage liquidity, and fund operations.

Conclusion

The cash flow statement is an essential financial tool that offers valuable insights into a company’s cash management and operational efficiency. By understanding its components and significance, stakeholders can better assess a company’s financial health and make informed decisions.

Effective cash flow management is crucial for business success, providing a clear picture of how cash is generated and used to support growth and sustainability.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.