The cash flow important in businesses cannot be overstated. It represents the lifeblood of any business, ensuring that operations continue smoothly, bills are paid on time, and growth opportunities are seized. Cash flow is the movement of money in and out of a business, and it is crucial for maintaining the financial health of the company.

Without sufficient cash flow, businesses may struggle to meet their financial obligations, which could ultimately lead to insolvency. Managing cash flow important helps businesses maintain a balance between incoming revenue and outgoing expenses, ensuring that they have enough liquidity to stay operational and thrive in competitive markets.

The critical role of cash flow in business success stems from its ability to impact various aspects of a company’s operations. From paying suppliers and employees to investing in growth and expansion, having positive cash flow allows businesses to remain flexible and responsive to market changes.

It also provides a buffer during economic downturns, enabling businesses to weather tough times without resorting to drastic measures like layoffs or loan defaults. Therefore, understanding and managing cash flow is essential for sustaining a business in the long term.

Why is the Cash Flow Cycle Important to Businesses?

The cash flow cycle is a fundamental concept in business finance. It refers to the process of converting cash into goods and services, which are then sold for revenue that eventually becomes cash again. The efficiency of this cycle determines how well a business can manage its financial obligations.

The shorter the cash flow cycle, the quicker a business can turn its investments into profits. This cycle directly affects the company’s liquidity, as it determines how long money is tied up in operations before it becomes available for use again. A well-managed cash flow cycle can reduce the need for external financing and improve overall profitability.

It is essential for businesses to monitor their cash flow cycle regularly. Delays in collecting payments from customers or paying suppliers can extend the cycle, leading to cash shortages. For example, if a business takes too long to collect receivables, it may not have enough cash to pay for raw materials, which can halt production.

By optimizing the cash flow cycle, businesses can improve their financial stability and reduce the risk of cash flow disruptions, which can be detrimental to their operations and growth.

How Does Cash Flow Affect the Profit of Your Business?

The relationship between cash flow and profit is often misunderstood. While profit is an accounting concept that shows the financial performance of a business over a specific period, cash flow represents the actual movement of money in and out of the business.

A company can be profitable on paper but still face cash flow problems if it does not have enough liquid assets to cover its immediate expenses. Therefore, managing cash flow is just as important as generating profit, if not more so, in some cases.

It is crucial for business owners to understand that profit does not always equate to positive cash flow. For example, a business might record a profit on its income statement but struggle with cash flow issues if it has unpaid invoices or delayed payments.

To ensure long-term success, businesses must focus on both profit and cash flow management, ensuring that their operations are sustainable and that they have enough cash to meet their financial obligations at all times.

What are the Benefits of a Cash Flow Statement?

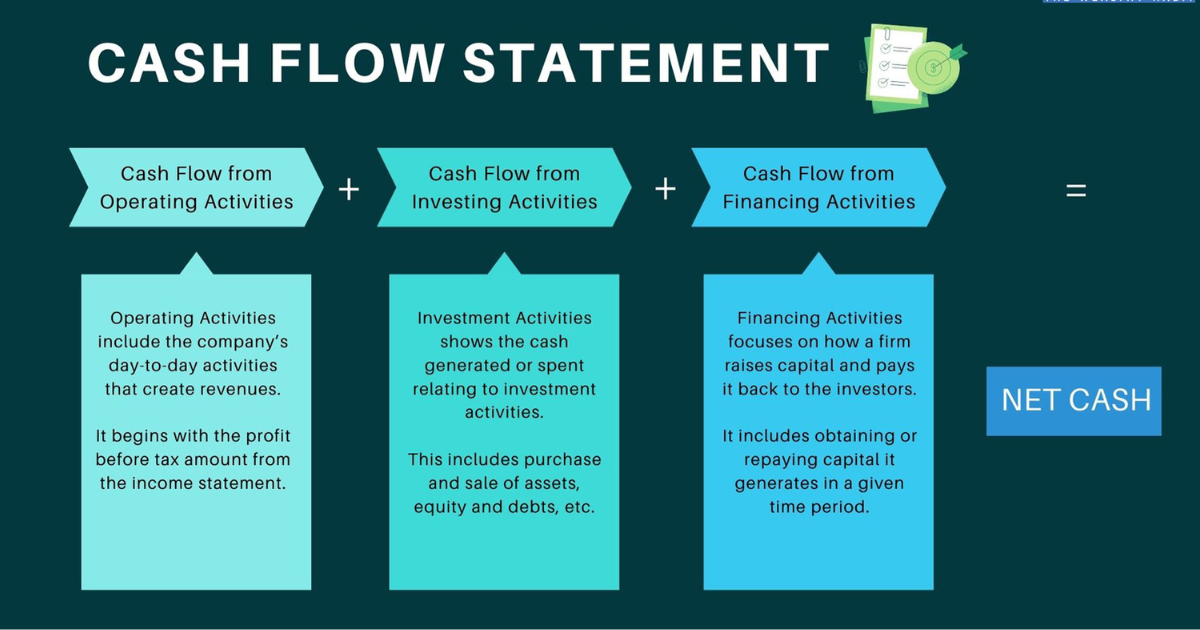

A cash flow statement is a vital financial document that provides insights into a company’s cash inflows and outflows over a specific period. It allows business owners to track where their money is coming from and how it is being spent, offering a clear picture of the company’s financial health.

One of the main benefits of a cash flow statement is that it helps businesses identify trends and patterns in their cash flow, enabling them to make informed decisions about their finances.

The cash flow statement also serves as a tool for forecasting future cash needs. By analyzing past cash flow patterns, businesses can predict potential cash shortages or surpluses and plan accordingly.

This proactive approach to cash flow management can help businesses avoid financial crises and take advantage of growth opportunities. Cash flow statements are essential for attracting investors and lenders, as they provide transparency and demonstrate the company’s ability to manage its finances effectively.

Why Cash Flow Budgets Are Important for Businesses?

Cash flow budgets play a crucial role in helping businesses plan for the future. A cash flow budget is a financial plan that estimates the cash inflows and outflows for a specific period, usually a year. By forecasting cash flow, businesses can anticipate potential financial challenges and take steps to address them before they become problematic.

Cash flow budgets allow businesses to allocate resources efficiently, ensuring that they have enough cash to cover their expenses and invest in growth opportunities.

It is important for businesses to create realistic cash flow budgets based on accurate financial data. Overestimating revenue or underestimating expenses can lead to cash flow problems down the line.

Regularly reviewing and updating cash flow budgets helps businesses stay on track and make adjustments as needed. With a well-planned cash flow budget, businesses can avoid unexpected cash shortages, reduce their reliance on external financing, and improve their overall financial stability.

The Impact of Cash Flow on Business Growth

The ability to manage cash flow effectively can significantly impact a business’s growth potential. Positive cash flow allows businesses to invest in new products, services, and technologies, enabling them to expand their operations and reach new markets.

Without sufficient cash flow, businesses may struggle to take advantage of growth opportunities, as they may not have the necessary funds to invest in expansion. Therefore, maintaining a healthy cash flow is essential for businesses that want to grow and remain competitive in their industries.

It is important for businesses to strike a balance between reinvesting in their operations and maintaining enough cash reserves to cover their day-to-day expenses. Overextending financially by investing too much in growth initiatives without sufficient cash flow can lead to cash shortages and financial difficulties. By carefully managing their cash flow, businesses can ensure that they have the resources they need to grow sustainably and achieve long-term success.

Cash Flow and Business Survival

For many businesses, particularly small and medium-sized enterprises (SMEs), cash flow is the difference between survival and failure. Even profitable businesses can fail if they do not manage their cash flow effectively.

A lack of cash flow can prevent businesses from paying their bills, meeting payroll, and fulfilling other financial obligations, leading to financial distress and, in extreme cases, bankruptcy. Therefore, cash flow management is critical for ensuring the survival of a business, especially during challenging economic times.

It is essential for businesses to monitor their cash flow closely and take action at the first signs of trouble. Implementing strategies such as improving collections, negotiating better payment terms with suppliers, and cutting unnecessary expenses can help businesses maintain positive cash flow and avoid financial difficulties. By prioritizing cash flow management, businesses can increase their chances of surviving and thriving in the long term.

The Role of Cash Flow in Managing Debt

Managing debt is a critical aspect of business finance, and cash flow plays a significant role in determining a company’s ability to meet its debt obligations. Businesses with strong cash flow are better positioned to repay loans and other forms of debt, which can improve their creditworthiness and reduce the cost of borrowing. On the other hand, businesses with weak cash flow may struggle to meet their debt obligations, leading to late payments, penalties, and even default.

It is crucial for businesses to assess their cash flow before taking on new debt. By ensuring that they have enough cash flow to cover their debt payments, businesses can avoid financial stress and maintain their financial health.

Businesses should explore ways to improve their cash flow, such as increasing sales, reducing expenses, and optimizing their working capital, to ensure that they can meet their debt obligations and continue to grow.

Cash Flow and Employee Satisfaction

Cash flow also has a direct impact on employee satisfaction and morale. Businesses with positive cash flow are better able to pay their employees on time, provide benefits, and invest in employee development.

This can lead to higher employee satisfaction and retention, which is critical for maintaining a productive and motivated workforce. On the other hand, businesses with cash flow problems may struggle to meet payroll, leading to low employee morale and high turnover.

It is important for businesses to prioritize cash flow management to ensure that they can meet their payroll obligations and invest in their employees’ growth and development. By maintaining positive cash flow, businesses can create a positive work environment that attracts and retains top talent, which is essential for long-term success.

The Impact of Cash Flow on Supplier Relationships

Cash flow also plays a significant role in maintaining strong relationships with suppliers. Businesses with positive cash flow are better positioned to pay their suppliers on time, which can lead to better terms and discounts. On the other hand, businesses with cash flow problems may struggle to pay their suppliers, leading to strained relationships and potential disruptions in the supply chain.

It is crucial for businesses to manage their cash flow effectively to ensure that they can meet their financial obligations to suppliers. By maintaining strong relationships with suppliers, businesses can secure better terms, improve their supply chain efficiency, and reduce the risk of disruptions that can impact their operations.

Cash Flow and Customer Satisfaction

Customer satisfaction is another area where cash flow can have a significant impact. Businesses with positive cash flow are better able to invest in customer service, product quality, and other areas that contribute to a positive customer experience. This can lead to higher customer satisfaction, repeat business, and positive word-of-mouth referrals, which are critical for long-term success.

On the other hand, businesses with cash flow problems may struggle to invest in customer service and other areas that contribute to a positive customer experience. This can lead to lower customer satisfaction and a decline in sales. Therefore, it is essential for businesses to manage their cash flow effectively to ensure that they can invest in the areas that contribute to customer satisfaction and long-term success.

Cash Flow and Business Flexibility

Cash flow also provides businesses with the flexibility to respond to changing market conditions and seize new opportunities. Businesses with positive cash flow are better positioned to invest in new products, services, and technologies, as well as respond to unexpected challenges such as economic downturns or supply chain disruptions. This flexibility is essential for maintaining a competitive edge in today’s fast-paced business environment.

It is important for businesses to prioritize cash flow management to ensure that they have the flexibility to adapt to changing market conditions and seize new opportunities. By maintaining positive cash flow, businesses can remain agile and responsive, which is critical for long-term success.

Frequently Asked Questions

Q1: What is the difference between cash flow and profit?

Cash flow represents the actual movement of money in and out of a business, while profit is an accounting concept that shows the financial performance of a business over a specific period. A business can be profitable but still face cash flow problems if it does not have enough liquid assets to cover its immediate expenses.

Q2: How can businesses improve their cash flow?

Businesses can improve their cash flow by increasing sales, reducing expenses, optimizing their working capital, improving collections, and negotiating better payment terms with suppliers. Regularly reviewing and updating cash flow budgets can also help businesses stay on track and avoid cash shortages.

Q3: Why is cash flow important for small businesses?

Cash flow important for small businesses because they often have limited financial resources and may not have access to external financing. Effective cash flow management helps small businesses cover their expenses, invest in growth, and avoid financial difficulties.

Q4: How does cash flow affect business growth?

Positive cash flow allows businesses to invest in new products, services, and technologies, enabling them to expand their operations and reach new markets. Without sufficient cash flow, businesses may struggle to take advantage of growth opportunities and maintain their competitive edge.

Conclusion

The cash flow important for businesses cannot be overstated. It is the lifeblood of any company, ensuring that operations continue smoothly, financial obligations are met, and growth opportunities are seized.

By managing cash important, businesses can maintain their financial health, improve their relationships with suppliers and customers, and invest in their employees’ growth and development. Ultimately, cash flow management is critical for ensuring the long-term success and survival of a business.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.