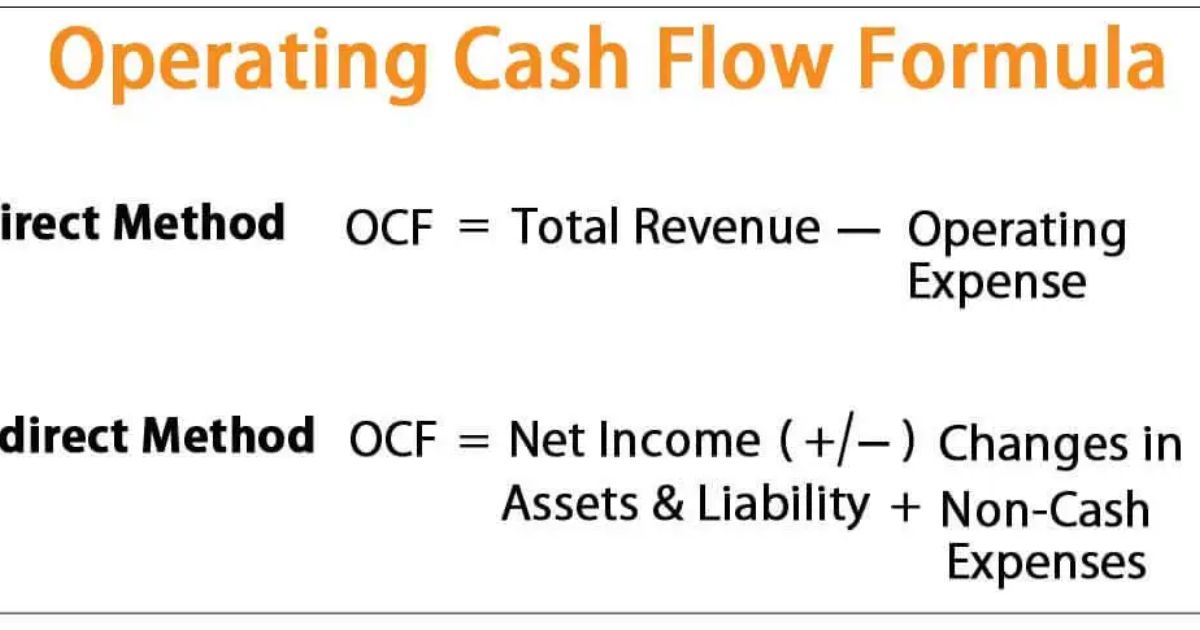

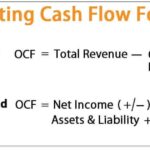

The operating cash flow (OCF) is a crucial financial metric that reveals the cash a company generates from its core business operations. It represents the cash inflows and outflows. It is directly related to the company’s regular business activities, excluding financing and investing activities.Understanding operating cash flow is essential for evaluating a company’s financial health and its ability to sustain and grow its operations.

How Does Revenue Impact Cash Flow?

The impact of revenue on cash flow is significant. Revenue, generated from sales of goods or services, directly affects cash flow by influencing the cash inflows

- Cash Inflows

Increased revenue results in higher cash inflows as sales generate cash or receivables. This positively impacts operating cash flow by boosting the available cash for business operations.

- Operational Efficiency

Higher revenue can improve operational efficiency, as increased sales can spread fixed costs over a larger revenue base, leading to better cash flow management.

- Expense Coverage

Adequate revenue allows a company to cover its operating expenses more comfortably. This ensures that cash flow remains stable despite fluctuations in cash inflows and outflows.

- Reinvestment

Increased revenue provides more funds for reinvestment in the business, supporting growth and enhancing cash flow over time.

Does Revenue Increase Cash?

Revenue alone does not directly increase cash but contributes to cash flow in several ways

- Cash Collection

When revenue is collected in cash, it directly increases the cash balance. However, if sales are on credit, cash inflow occurs only when payments are received.

- Accounts Receivable

Revenue increases accounts receivable, which represents cash owed by customers. Efficient collection of receivables ensures that revenue translates into cash.

- Cash Flow Conversion

The conversion of revenue into cash depends on the company’s ability to manage receivables and inventory efficiently. Timely collection of receivables is crucial for positive cash flow.

- Operational Impact

Revenue affects operational cash flow by influencing the cash available for business activities. Effective management of revenue impacts cash flow positively by ensuring that cash is available for operational needs.

Does Revenue Recognition Affect Cash Flow?

Revenue recognition, which determines when revenue is recorded in financial statements, has a notable effect on cash flow

- Accrual Accounting

Under accrual accounting, revenue is recognized when earned, regardless of when cash is received. This can create a discrepancy between reported revenue and actual cash flow.

- Revenue Timing

The timing of revenue recognition affects when cash flows are realized. Proper revenue recognition ensures that financial statements accurately reflect cash flow.

- Deferred Revenue

Revenue received in advance is recorded as deferred revenue, impacting cash flow positively when cash is received but not immediately affecting revenue recognition.

- Compliance

Adhering to revenue recognition standards ensures accurate reporting and impacts cash flow visibility. This compliance supports reliable financial statements and cash flow management.

How Does Increase in Sales Affect Cash Flow?

An increase in sales impacts cash flow in several ways

- Enhanced Cash Inflows

Higher sales lead to increased cash inflows from customers. This improves operating cash flow by boosting the cash available for business operations.

- Working Capital Requirements

Increased sales may require additional working capital to manage higher inventory and accounts receivable. Effective management of working capital ensures that increased sales contribute positively to cash flow.

- Operational Costs

Higher sales can lead to higher operational costs, such as increased production or delivery expenses. Balancing these costs with increased revenue is crucial for maintaining positive cash flow.

- Growth Opportunities

Increased sales provide more resources for growth and investment opportunities. This can enhance cash flow by supporting business expansion and improving financial stability.

The Importance of Operating Cash Flow

Operating cash flow is a key indicator of a company’s financial health and its ability to generate cash from core operations

- Financial Stability

Positive operating cash flow indicates that a company generates sufficient cash to cover its operating expenses and support growth.

- Investment Capability

Strong operating cash flow provides the company with the resources to invest in new projects, research and development, and expansion.

- Debt Management

Adequate operating cash flow allows a company to meet its debt obligations and manage interest payments effectively.

- Liquidity

Operating cash flow affects a company’s liquidity, which is essential for day-to-day operations and managing unforeseen expenses.

How Revenue Streams Impact Operating Cash Flow

Different revenue streams affect operating cash flow in various ways

- Recurring Revenue

Stable, recurring revenue streams, such as subscription fees or service contracts, provide predictable cash inflows and enhance operating cash flow stability.

- Seasonal Revenue

Seasonal fluctuations in revenue can impact operating cash flow. Effective planning and cash reserves help manage these variations and maintain positive cash flow.

- High-Margin Revenue

Revenue from high-margin products or services contributes more to operating cash flow by generating higher cash inflows relative to costs.

- Revenue Diversification

Diversifying revenue streams reduces dependence on a single source and enhances cash flow stability by spreading risk.

Managing Cash Flow with Revenue Projections

Accurate revenue projections are essential for effective cash flow management

- Forecasting

Revenue forecasts provide insights into future cash flow, enabling businesses to plan for cash needs and manage operational expenses.

- Budgeting

Effective budgeting based on revenue projections helps allocate resources efficiently and maintain positive operating cash flow.

- Strategic Planning

Revenue projections support strategic planning by informing decisions on investments, cost management, and growth initiatives.

- Cash Flow Analysis

Analyzing cash flow in relation to revenue projections helps identify potential cash flow issues and implement corrective measures.

The Impact of Accounts Receivable on Operating Cash Flow

Accounts receivable significantly impacts operating cash flow

- Cash Collection

Efficient management of accounts receivable ensures timely collection of payments, converting revenue into cash and improving operating cash flow.

- Credit Policies

Implementing effective credit policies helps manage accounts receivable and reduce the risk of delayed payments, supporting positive cash flow.

- Aging Analysis

Monitoring accounts receivable aging reports helps identify overdue accounts and take necessary actions to improve cash flow.

- Customer Relationships

Building strong relationships with customers facilitates timely payments and enhances cash flow.

How Revenue Recognition Affects Financial Statements?

Revenue recognition affects the accuracy of financial statements and operating cash flow

- Accrual vs. Cash Accounting

Accrual accounting records revenue when earned, cash accounting records it when received. This difference impacts how revenue and cash flow are reported.

- Revenue Standards

Compliance with revenue recognition standards, such as IFRS 15 or ASC 606, ensures accurate financial reporting and reflects true cash flow.

- Revenue Adjustments

Adjustments to revenue recognition may be necessary to align with actual cash flows, impacting the accuracy of financial statements.

- Transparency

Accurate revenue recognition provides transparency in financial statements, supporting reliable cash flow analysis and decision-making.

The Role of Cash Flow in Business Planning

Operating cash flow plays a crucial role in business planning

- Resource Allocation

Positive operating cash flow allows for effective allocation of resources, supporting business operations and growth initiatives.

- Financial Strategy

Operating cash flow informs financial strategy by providing insights into cash generation capabilities and operational efficiency.

- Risk Management

Analyzing operating cash flow helps identify potential financial risks and implement strategies to mitigate them.

- Performance Measurement

Operating cash flow serves as a key performance indicator, measuring the company’s ability to generate cash from core operations.

Monitoring and Improving Operating Cash Flow

Monitoring and improving operating cash flow involves several strategies

- Cash Flow Management

Regular monitoring of cash flow helps identify trends and manage fluctuations effectively, ensuring positive operating cash flow.

- Cost Control

Implementing cost control measures helps reduce operational expenses and improve cash flow by increasing the cash available from operations.

- Revenue Optimization

Enhancing revenue streams and managing pricing strategies can improve cash flow by increasing cash inflows.

- Financial Analysis

Conducting financial analysis and forecasting helps identify opportunities for improving operating cash flow and achieving financial goals.

Frequently Asked Questions

Q1. What is operating cash flow?

Operating cash flow is the cash generated from a company’s core business operations, excluding financing and investing activities. It reflects the cash inflows and outflows directly related to regular business activities.

Q2. How does revenue impact cash flow?

Revenue impacts cash flow by increasing cash inflows when sales are made and payments are received. Higher revenue typically leads to improved cash flow if receivables and expenses are managed efficiently.

Q3. Does revenue recognition affect cash flow?

Yes, revenue recognition affects cash flow by determining when revenue is recorded in financial statements. Proper recognition ensures accurate reporting and reflects true cash flow.

Q4. How does an increase in sales affect cash flow?

An increase in sales improves cash flow by boosting cash inflows from customers. However, it requires effective management of working capital and operational costs to ensure positive cash flow.

Conclusion

Understanding operating cash flow is essential for assessing a company’s financial health and sustainability. By analyzing the impact of revenue, sales increases, and revenue recognition, businesses can manage their cash flow effectively. Positive operating cash flow supports operational stability, growth, and financial flexibility, making it a critical component of successful business management.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.