Cash flow budgeting is an essential tool for managing finances effectively, whether for personal use or business operations. By understanding how to plan and manage cash flow, individuals and organizations can ensure they have enough liquidity to meet their obligations and seize opportunities. This article will provide a detailed overview of cash flow budgeting, including its definition, preparation, and key differences compared to comprehensive budgets.

What is the Definition of Cash Flow Budget?

The cash flow budget is a financial plan that estimates the cash inflows and outflows over a specific period. It helps track the actual flow of cash into and out of an organization or individual’s finances.

By forecasting cash movements, the cash flow budget ensures that there is sufficient cash available to meet short-term obligations and avoid liquidity issues. It provides a snapshot of expected financial activity, enabling better decision-making and financial management.

What is Meant by Cash Budgeting?

The term “cash budgeting” refers to the process of planning and managing cash flow to ensure that there are adequate funds available for various expenses. It involves creating a detailed plan that outlines expected cash inflows, such as revenues or payments received, and outflows, such as bills or expenses.

The term “cash budgeting” refers to the process of planning and managing cash flow to ensure that there are adequate funds available for various expenses. It involves creating a detailed plan that outlines expected cash inflows, such as revenues or payments received, and outflows, such as bills or expenses.

Cash budgeting helps in anticipating periods of surplus or shortage, allowing for proactive measures to address potential cash flow challenges. The goal is to maintain a balance where cash inflows consistently meet or exceed outflows.

How to Prepare a Cash Flow Budget?

The preparation of a cash flow budget involves several key steps. The first step is to estimate cash inflows by analyzing past revenue trends, sales projections, and any other sources of income.

The next step is to project cash outflows, including fixed expenses like rent and variable costs such as utilities.It is essential to account for both regular payments and irregular expenses.

Once inflows and outflows are estimated, they should be compiled into a cash flow statement, which can be used to monitor and adjust financial plans. Regularly updating the budget helps in adapting to changes in financial conditions and ensuring accurate forecasting.

What is the Difference Between a Comprehensive Budget and a Cash Flow Budget?

The comprehensive budget, also known as a master budget, encompasses all aspects of an organization’s financial planning, including income, expenses, capital expenditures, and financing.

It provides a broad overview of financial performance and is used for long-term planning. In contrast, the cash flow budget focuses specifically on cash movements over a short period, such as monthly or quarterly.

It provides a detailed view of cash inflows and outflows, ensuring that there is enough liquidity to meet immediate financial needs. The comprehensive budget offers a complete financial picture, the cash flow budget is crucial for day-to-day cash management.

The Importance of Cash Flow Budgeting in Business

The role of cash flow budgeting in business cannot be overstated. It helps businesses anticipate cash shortages and surpluses, enabling them to make informed decisions about expenditures, investments, and financing.

Effective cash flow management prevents disruptions in operations and helps businesses maintain good relationships with suppliers and creditors. It also aids in strategic planning, allowing businesses to allocate resources efficiently and plan for future growth.

Common Challenges in Cash Flow Budgeting

The cash flow budgeting process can present several challenges. One common issue is inaccurate forecasting of cash inflows and outflows, which can lead to unexpected shortages or surpluses.Another challenge is managing seasonal fluctuations in cash flow, which can affect businesses with varying sales cycles.

Unforeseen expenses or changes in revenue patterns can disrupt cash flow projections. Addressing these challenges requires regular review and adjustment of the cash flow budget to reflect real-time financial conditions.

How to Address Cash Flow Shortages?

When facing a cash flow shortage, it is essential to implement strategies to address the issue promptly. One approach is to review and adjust the budget to identify areas where expenses can be reduced or deferred.

When facing a cash flow shortage, it is essential to implement strategies to address the issue promptly. One approach is to review and adjust the budget to identify areas where expenses can be reduced or deferred.

Increasing cash inflows through accelerated receivables or additional sales can also help. Exploring short-term financing options, such as lines of credit or loans, may provide temporary relief. Improving cash management practices, such as better inventory control or negotiating payment terms with suppliers, can help alleviate cash flow issues.

The Role of Technology in Cash Flow Budgeting

Technology plays a significant role in enhancing cash flow budgeting processes. Financial software and tools can automate cash flow forecasting, track transactions in real-time, and generate detailed reports.

These tools provide valuable insights and help streamline the budgeting process. Cloud-based solutions allow for collaboration and access to financial data from anywhere, improving accuracy and efficiency in cash flow management.

The Benefits of Regular Cash Flow Reviews

Regular reviews of the cash flow budget offer several benefits. They help in identifying discrepancies between projected and actual cash flows, allowing for timely adjustments.

Frequent reviews also enable businesses to adapt to changing financial conditions and stay on top of potential issues. By regularly monitoring cash flow, organizations can make informed decisions, improve financial planning, and ensure sustained liquidity.

How Cash Flow Budgeting Affects Long-Term Financial Planning?

Cash flow budgeting primarily focuses on short-term financial management, it also impacts long-term financial planning. A well-maintained cash flow budget provides a solid foundation for forecasting future financial needs and planning investments.

Cash flow budgeting primarily focuses on short-term financial management, it also impacts long-term financial planning. A well-maintained cash flow budget provides a solid foundation for forecasting future financial needs and planning investments.

It helps businesses understand their cash flow patterns, allowing for better long-term strategies and growth planning. Effective cash flow management supports overall financial stability and contributes to achieving long-term financial goals.

The Connection Between Cash Flow Budgeting and Profitability

The connection between cash flow budgeting and profitability is significant. Effective cash flow management ensures that a business has sufficient cash to support its operations and growth initiatives.

By optimizing cash flow, businesses can avoid financial constraints that may hinder profitability. Strong cash flow practices enable businesses to reinvest profits into growth opportunities, enhancing overall financial performance.

How to Use Cash Flow Budgeting for Personal Finance

In personal finance, cash flow budgeting helps individuals manage their income and expenses effectively. By tracking cash inflows, such as salaries or investments, and outflows, such as bills and discretionary spending, individuals can maintain financial control and achieve their financial goals.

Personal cash flow budgeting also helps in planning for future expenses, saving for emergencies, and avoiding debt. It provides a clear picture of financial health and supports better money management practices.

Cash Flow Budgeting vs. Profit and Loss Budgeting

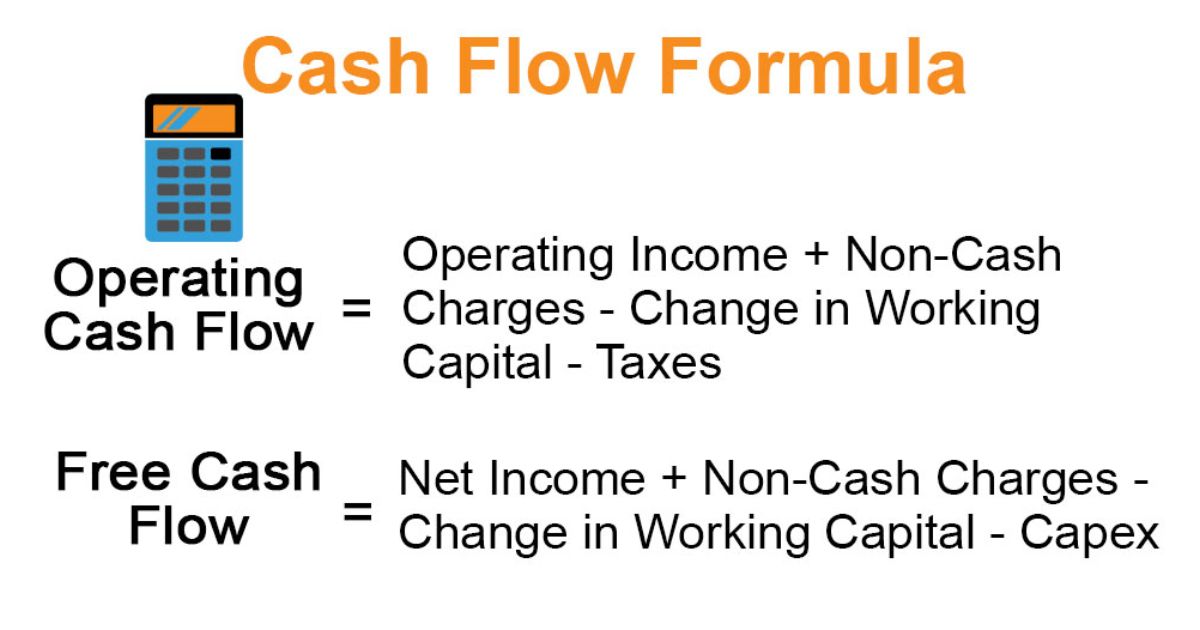

Cash flow budgeting and profit and loss budgeting are two distinct financial planning approaches. Cash flow budgeting focuses on the actual flow of cash into and out of a business or individual’s finances, profit and loss budgeting (also known as income statement budgeting) examines revenue and expenses to determine profitability.

The key difference is that cash flow budgeting deals with liquidity and short-term financial management, whereas profit and loss budgeting assesses overall financial performance and profitability.

The Role of Cash Flow Budgeting in Startup Success

For startups, cash flow budgeting is crucial for success. It helps in managing limited resources, ensuring that there is enough cash to cover initial expenses and ongoing operations.

A well-prepared cash flow budget allows startups to plan for growth, manage investor expectations, and navigate the challenges of early-stage financing. By maintaining a clear picture of cash flow, startups can make informed decisions and increase their chances of long-term success.

The Future of Cash Flow Budgeting

The future of cash flow budgeting is likely to be influenced by advancements in technology and data analytics. Emerging tools and technologies will offer more accurate and efficient ways to manage cash flow.

Predictive analytics and artificial intelligence may provide deeper insights into cash flow patterns and trends, enabling better forecasting and decision-making. As financial management continues to evolve, cash flow budgeting will remain a critical component of effective financial planning.

Frequently Asked Questions

1. What is the primary purpose of a cash flow budget?

The primary purpose of a cash flow budget is to forecast and manage the actual cash inflows and outflows over a specific period. It ensures that there is enough cash available to meet short-term obligations, prevent liquidity issues, and make informed financial decisions.

2. How often should a cash flow budget be reviewed?

A cash flow budget should be reviewed regularly, ideally on a monthly or quarterly basis. Frequent reviews help in identifying discrepancies, adjusting for changes in financial conditions, and ensuring accurate forecasting.

3. Can cash flow budgeting help with long-term financial planning?

Yes, cash flow budgeting can assist with long-term financial planning by providing insights into cash flow patterns and trends. It helps in understanding financial needs, planning for investments, and supporting overall financial stability and growth.

4. What are some common mistakes in cash flow budgeting?

Common mistakes in cash flow budgeting include inaccurate forecasting of inflows and outflows, failing to account for irregular expenses, and not updating the budget regularly. These errors can lead to cash flow shortages or surpluses and disrupt financial management.

Conclusion

Cash flow budgeting is a vital tool for effective financial management, providing a detailed view of cash inflows and outflows. By understanding its definition, preparation, and differences from comprehensive budgeting, individuals and businesses can better manage their finances.

Regular reviews, leveraging technology, and addressing common challenges are key to successful cash flow budgeting. As financial practices evolve, maintaining a strong grasp of cash flow budgeting will continue to be essential for achieving financial stability and long-term success.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.