Cash flow management is all about keeping track of the money coming in and going out of your business. It’s key to making sure you have enough cash to cover expenses and grow. By following best practices, you can avoid financial stress and keep your business healthy.

Managing cash flow is crucial for any business to thrive. Without proper cash flow management, even profitable businesses can struggle. So, what are the best practices for cash flow management? Let’s dive into strategies that can help you stay on top of your finances and ensure your business’s success.

Understanding the best practices for cash flow management can make a significant difference in your business’s financial health. By implementing these strategies, you’ll be better equipped to handle unexpected expenses, plan for growth, and maintain stability. Read on to discover the essential steps that can help you master cash flow management and secure your business’s future.

Effective cash flow management is the backbone of any successful business, ensuring that a company has enough liquidity to meet its short-term obligations while planning for long-term growth.

Proper management of cash flow can be the difference between thriving and struggling in the ever-changing business world. This article will delve into the best practices for managing cash flow, ensuring your business remains on solid financial ground.

How to Manage Cash Flow Effectively?

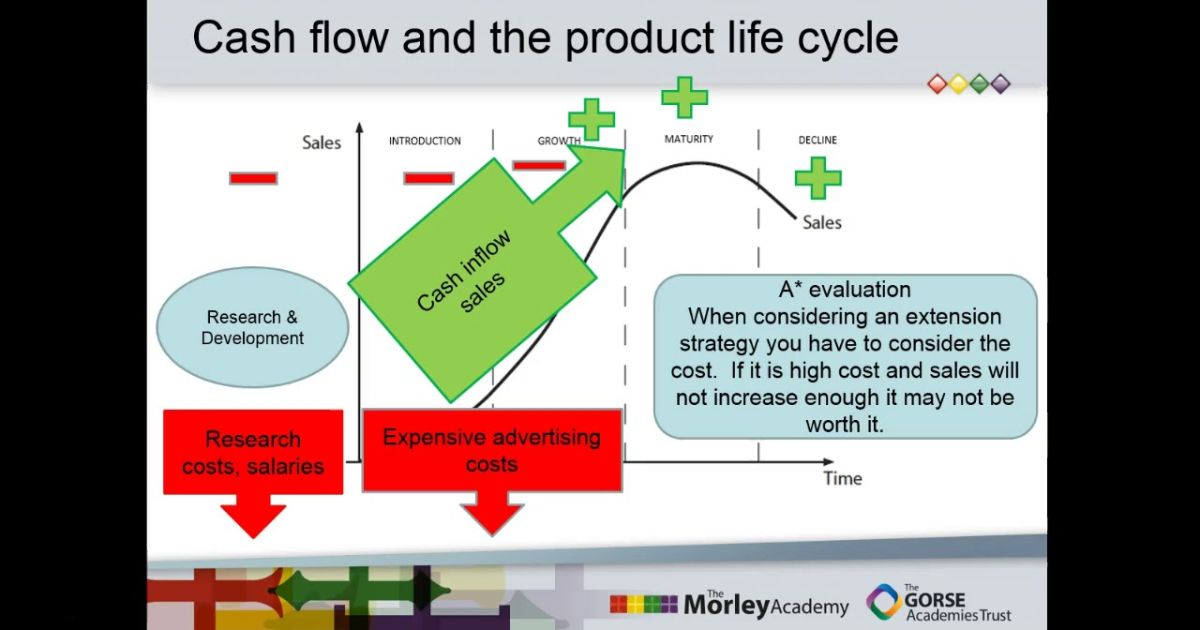

The first step in managing cash flow effectively is understanding your business’s cash inflows and outflows. The key to success lies in consistently monitoring your cash flow statements and making informed decisions based on that data.

This can be done through cash flow forecasting, which involves predicting your future income and expenses. It enables businesses to prepare for any potential cash shortages and make informed financial decisions.

It is equally important to maintain a cash reserve that can cover your operating expenses for at least three to six months. This safety net can protect your business during slow periods or unexpected financial challenges. Prioritise timely invoicing and ensure that your clients adhere to payment deadlines to avoid unnecessary delays in cash inflow.

What Are the Five Techniques in Cash Management?

Cash management involves employing strategies to optimise the use of your cash resources. Here are five effective techniques

- Cash Flow Forecasting

Predicting future cash inflows and outflows can help anticipate potential shortfalls and make adjustments accordingly.

- Efficient Invoicing

Sending out invoices promptly and following up on late payments ensures a steady cash inflow.

- Managing Payables and Receivables

Delaying your payables as long as possible while collecting receivables quickly helps maintain a positive cash flow.

- Negotiating Payment Terms

Establishing favourable payment terms with suppliers can provide flexibility in managing outflows.

- Utilizing Cash Management Tools

Leveraging software tools to track, analyze, and forecast cash flow can make the process more efficient and accurate.

What Are the Four Components of Cash Flow Management?

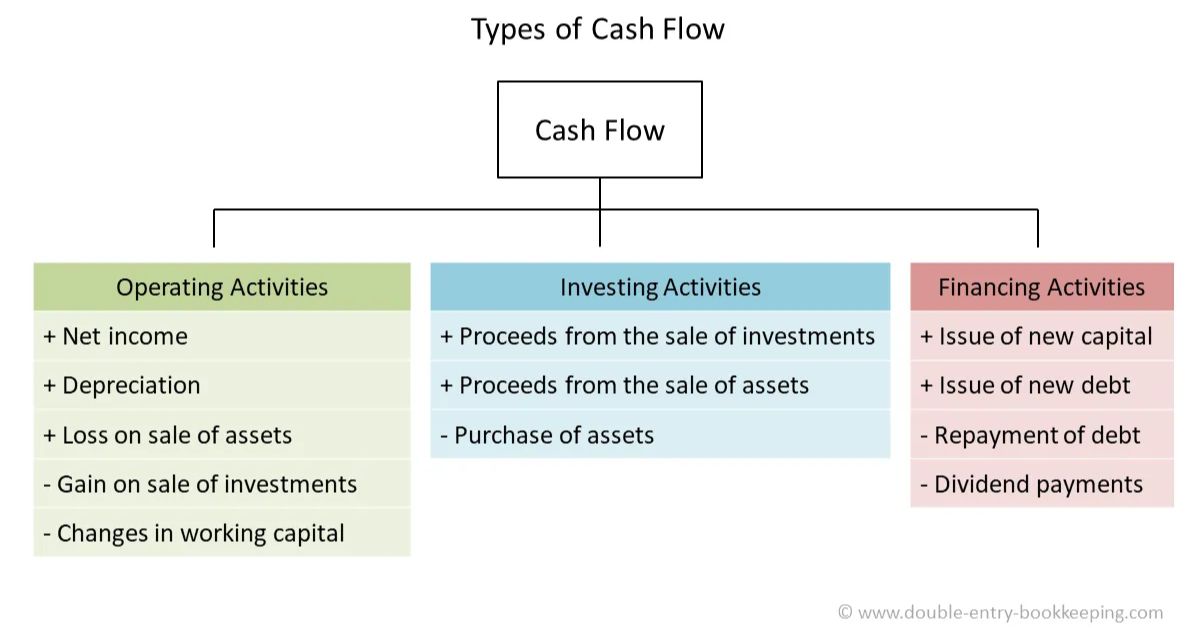

Effective cash flow management involves understanding the four key components that make up your cash flow

- Operating Activities

This includes day-to-day business activities such as sales, expenses, and income from regular operations. It’s crucial to maintain a positive cash flow from operating activities to ensure business sustainability.

- Investing Activities

These are the cash inflows and outflows related to purchasing or selling assets, such as equipment or real estate. Proper planning for investing activities can help optimise returns on investments while ensuring sufficient liquidity.

- Financing Activities

This component covers cash transactions involving debt, equity, and dividends. Managing these activities well helps ensure your business can finance its operations and growth without compromising financial stability.

- Net Cash Flow

The sum of all cash inflows and outflows determines your net cash flow, reflecting the overall liquidity of your business. Regularly analysing this helps you spot trends and adjust strategies accordingly.

Which of the Following Is a Cash Management Best Practice?

A vital cash management best practice is keeping an eye on your working capital. Working capital is the difference between current assets and current liabilities, and it directly affects your company’s liquidity. To optimise working capital, businesses should focus on improving inventory management, reducing receivables, and extending payables when possible.

Another best practice is adopting technology for cash management. Cash management software provides real-time insights into your financial position, enabling quicker decision-making. These tools help automate tasks such as invoicing, tracking expenses, and forecasting, freeing up time for more strategic activities.

Why Is Cash Flow Management Important for Business Success?

The health of a business largely depends on its ability to manage cash flow effectively. It is a crucial factor in determining a company’s ability to pay bills, fund operations, and invest in growth opportunities.

Without proper cash flow management, even profitable businesses can run into financial difficulties, leading to missed opportunities, mounting debt, or, in the worst case, bankruptcy. Cash flow management ensures that there is always enough cash to cover expenses, from paying suppliers to meeting payroll.

By staying on top of cash flow, businesses can avoid the pitfalls of late payments and penalties, which can quickly erode profits. Moreover, proper cash flow management also helps companies build a strong credit profile, making it easier to secure financing when needed.

How Can Small Businesses Improve Cash Flow?

Small businesses often face unique challenges in managing cash flow, but there are several strategies they can employ to improve their financial situation. One of the most effective methods is reducing unnecessary expenses. By regularly reviewing expenses and cutting non-essential costs, small businesses can free up cash for critical needs.

Another key strategy is offering discounts for early payments. Incentivizing customers to pay early can speed up cash inflows and reduce the risk of overdue payments. Additionally, small businesses can consider leasing equipment instead of purchasing it outright, which can help conserve cash and spread payments over time.

The Role of Cash Flow Forecasting in Business Planning

Cash flow forecasting plays a pivotal role in business planning. By predicting future cash inflows and outflows, businesses can make informed decisions about investments, hiring, and other key activities.

A well-prepared cash flow forecast allows businesses to anticipate challenges and opportunities, ensuring that they are always financially prepared. Forecasting also enables businesses to set realistic goals and budgets.

By understanding their financial position, companies can allocate resources more effectively and avoid overextending themselves. Regularly updating cash flow forecasts is essential, as it allows businesses to adjust their strategies in response to changes in the market or their operations.

Common Cash Flow Pitfalls to Avoid

There are several common pitfalls that businesses should avoid when managing cash flow. One of the most significant is failing to monitor cash flow regularly. Without consistent monitoring, businesses can quickly lose track of their financial position, leading to cash shortages and financial stress.

Another common mistake is over-relying on credit. While credit can be a valuable tool for managing cash flow, overusing it can lead to mounting debt and high-interest payments, which can strain cash reserves. It’s essential to use credit wisely and ensure that payments can be made on time.

How to Optimize Working Capital?

Optimizing working capital is crucial for maintaining a healthy cash flow. One effective strategy is improving inventory management. By keeping inventory levels in line with demand, businesses can avoid tying up too much cash in stock while ensuring they have enough products to meet customer needs.

Another strategy is reducing accounts receivable. Businesses can encourage customers to pay sooner by offering incentives or implementing stricter payment terms. Additionally, extending payment terms with suppliers can help conserve cash, as it allows businesses to hold onto their money for longer.

The Benefits of Cash Flow Automation

Automating cash flow management can provide numerous benefits for businesses of all sizes. Automation tools can help streamline processes such as invoicing, payment tracking, and expense management, reducing the time and effort required to manage cash flow manually.

Automation also provides real-time insights into a company’s financial position, enabling quicker decision-making and more accurate forecasting. By automating routine tasks, businesses can free up time to focus on more strategic activities, such as identifying growth opportunities and optimizing operations.

How to Build a Cash Reserve for Emergencies?

Building a cash reserve is essential for protecting your business during challenging times. A cash reserve acts as a financial safety net, ensuring that your company can continue operating even during periods of low revenue or unexpected expenses.

The first step in building a cash reserve is determining how much money your business needs to cover operating expenses for a set period, typically three to six months. Once you have a target amount, you can start setting aside a portion of your profits each month until you reach your goal. It’s essential to keep this reserve separate from your regular operating funds to ensure it is only used for emergencies.

Managing Seasonal Cash Flow Variations

Many businesses experience seasonal fluctuations in cash flow, which can make it challenging to maintain consistent liquidity throughout the year. To manage these variations effectively, businesses should plan ahead by creating a cash flow forecast that accounts for seasonal trends.

During peak seasons, businesses can build up cash reserves to carry them through slower periods. Additionally, diversifying revenue streams can help stabilize cash flow throughout the year. For example, businesses that rely on seasonal sales can offer off-season promotions or introduce new products to maintain revenue during slower periods.

How to Leverage Technology for Cash Flow Management?

Technology has revolutionized cash flow management, making it easier than ever for businesses to track, analyze, and optimize their cash flow. Cash flow management software provides real-time insights into a company’s financial position, enabling quicker decision-making and more accurate forecasting.

These tools can automate tasks such as invoicing, payment tracking, and expense management, reducing the time and effort required to manage cash flow manually. Additionally, many software solutions offer customizable dashboards and reports, allowing businesses to monitor key metrics and identify trends that can inform their cash flow strategies.

Frequently Asked Questions

Q1. What is cash flow management?

Cash flow management involves monitoring, analyzing, and optimizing the inflows and outflows of cash within a business. It ensures that a company has enough liquidity to meet its short-term obligations while planning for long-term growth.

Q2. How can businesses improve cash flow?

Businesses can improve cash flow by reducing expenses, improving invoicing practices, optimizing working capital, and leveraging technology for cash management.

Q3. What is the importance of cash flow forecasting?

Cash flow forecasting helps businesses predict future cash inflows and outflows, allowing them to plan for potential cash shortages and make informed financial decisions.

Q4. How can technology help with cash flow management?

Technology can help streamline cash flow management by automating tasks such as invoicing, payment tracking, and expense management, while providing real-time insights into a company’s financial position.

Conclusion

Effective cash flow management is essential for ensuring the financial health and long-term success of any business. By understanding the key components of cash flow, employing best practices, and leveraging technology, businesses can optimize their cash flow, improve liquidity, and position themselves for growth.

Whether you’re a small business owner or managing a larger enterprise, taking proactive steps to manage cash flow can help you navigate financial challenges and seize opportunities for expansion.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.