Positive cash flow refers to the amount of cash a business generates after accounting for all its expenses. It’s a crucial indicator of financial health and operational efficiency. The concept is simple yet powerful: when a business earns more money than it spends, it creates a positive cash flow. This fundamental aspect of financial management can significantly impact a company’s stability and growth prospects.

What Are the Advantages of Positive Cash Flow?

The advantages of positive cash flow extend beyond just maintaining a healthy balance sheet. It allows a business to reinvest in its operations, pay down debt, and enhance its financial flexibility.

The primary benefit is that it ensures the company can cover its short-term liabilities and operational costs without needing additional financing. Positive cash flow can boost investor confidence, leading to potential growth opportunities and better terms for future funding.

Is Positive Operating Cash Flow Good?

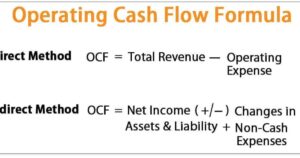

The presence of positive operating cash flow is a strong indicator of a company’s operational success. It shows that the business is generating sufficient revenue from its core operations to sustain its activities.

The presence of positive operating cash flow is a strong indicator of a company’s operational success. It shows that the business is generating sufficient revenue from its core operations to sustain its activities.

The operating cash flow is critical because it excludes cash flows from investing and financing activities, focusing purely on the day-to-day business activities. Thus, it highlights whether the core operations are profitable and sustainable over time.

Why Is Positive Free Cash Flow Important?

The importance of positive free cash flow lies in its ability to provide a buffer for a company’s strategic investments and growth initiatives. Free cash flow, calculated as operating cash flow minus capital expenditures, reflects the cash available for expansion, dividends, or debt reduction.

Positive free cash flow indicates that a company not only covers its operational needs but also has surplus funds for growth and shareholder returns. It’s a crucial metric for assessing long-term financial health and investment potential.

Should Cash Flow Be Positive or Negative?

The cash flow should ideally be positive for a business to thrive. Positive cash flow signifies that a company’s incoming cash exceeds its outgoing cash, which is essential for operational stability and growth.

Negative cash flow, on the other hand, can signal financial trouble and may require corrective actions such as cost reduction, revenue enhancement, or financing solutions. Short-term negative cash flow might be manageable, sustained negative cash flow can lead to liquidity issues and financial distress.

The Impact of Positive Cash Flow on Business Growth

The impact of positive cash flow on business growth cannot be overstated. It provides the financial resources needed to explore new markets, invest in innovation, and expand product lines.

With a steady influx of cash, businesses can capitalize on opportunities that require upfront investment, such as research and development or market expansion. Positive cash flow enables companies to make strategic decisions that drive long-term success and sustainability.

Enhancing Financial Stability Through Positive Cash Flow

The enhancement of financial stability through positive cash flow is a key benefit for any organization. It allows companies to build a financial cushion that can be used in times of economic uncertainty or unexpected expenses.

Financial stability fosters a strong credit rating, which can lead to better borrowing terms and conditions. Moreover, it contributes to a company’s ability to weather economic downturns and maintain operational continuity.

Positive Cash Flow and Investor Confidence

The correlation between positive cash flow and investor confidence is significant. Investors are more likely to be attracted to companies that demonstrate a consistent ability to generate positive cash flow, as it reflects operational efficiency and financial health.

The correlation between positive cash flow and investor confidence is significant. Investors are more likely to be attracted to companies that demonstrate a consistent ability to generate positive cash flow, as it reflects operational efficiency and financial health.

The assurance of steady cash flow can lead to increased investment and favorable terms for equity financing. Consequently, a company with robust cash flow is often viewed as a more reliable and attractive investment opportunity.

Managing Cash Flow Effectively

The management of cash flow effectively is vital for maintaining a positive cash flow. This involves monitoring cash inflows and outflows, optimizing inventory levels, and managing receivables and payables efficiently.

The implementation of cash flow management strategies can help identify potential issues before they become critical and ensure that the business remains on a positive trajectory. Effective cash flow management also involves forecasting future cash needs and planning accordingly.

The Role of Positive Cash Flow in Debt Management

The role of positive cash flow in debt management is crucial. Companies with strong cash flow can comfortably service their debt obligations, which helps maintain good relationships with creditors and lenders.

It also provides the flexibility to pay off existing debt faster, reduce interest expenses, and improve overall financial leverage. Positive cash flow can enhance a company’s creditworthiness and open doors to more favorable financing options.

Positive Cash Flow and Operational Efficiency

The connection between positive cash flow and operational efficiency is evident. Companies that generate positive cash flow are often those that manage their operations efficiently.

Effective cost control, streamlined processes, and optimized resource allocation contribute to higher cash flow. By improving operational efficiency, businesses can enhance their profitability and maintain a healthy cash flow, which is essential for sustained growth and competitive advantage.

The Significance of Cash Flow Forecasting

The significance of cash flow forecasting lies in its ability to provide insights into future cash needs and potential shortfalls. Accurate forecasting helps businesses plan for upcoming expenses, manage liquidity, and make informed financial decisions.

By projecting future cash flow, companies can identify trends, prepare for seasonal variations, and implement strategies to maintain a positive cash flow. Forecasting is a proactive approach to ensuring financial stability and supporting long-term goals.

Leveraging Positive Cash Flow for Strategic Investments

The leveraging of positive cash flow for strategic investments can significantly impact a company’s growth trajectory. With a strong cash position, businesses can invest in new technologies, enter new markets, or acquire other companies.

Strategic investments funded by positive cash flow can drive innovation, enhance competitive positioning, and create new revenue streams. Effective use of cash flow for strategic purposes can position a company for future success and market leadership.

Positive Cash Flow and Employee Benefits

The connection between positive cash flow and employee benefits is noteworthy. Companies with a healthy cash flow are better positioned to offer competitive salaries, bonuses, and benefits to their employees.

The connection between positive cash flow and employee benefits is noteworthy. Companies with a healthy cash flow are better positioned to offer competitive salaries, bonuses, and benefits to their employees.

This can lead to higher employee satisfaction, retention, and productivity. Positive cash flow also allows businesses to invest in employee development and training, further enhancing their workforce’s skills and capabilities. A motivated and well-compensated team contributes to overall business success.

The Long-Term Benefits of Sustained Positive Cash Flow

The long-term benefits of sustained positive cash flow are substantial. Over time, consistent positive cash flow helps build financial resilience and supports strategic growth initiatives. It provides a stable foundation for making long-term investments, expanding operations, and pursuing new opportunities.

Sustained positive cash flow also enhances a company’s ability to navigate economic fluctuations and maintain operational stability, ensuring long-term success and sustainability.

Frequently Asked Questions

1. What is positive cash flow, and why is it important?

Positive cash flow is the amount of cash a business generates after covering its expenses. It is important because it ensures that a company can meet its short-term obligations, invest in growth opportunities, and maintain financial stability. Positive cash flow also reflects operational efficiency and enhances investor confidence.

2. How can a business achieve positive cash flow?

A business can achieve positive cash flow by increasing revenue, managing expenses effectively, and optimizing cash management practices. Strategies include improving sales, controlling costs, managing inventory efficiently, and ensuring timely collection of receivables.

3. What are some common challenges to maintaining positive cash flow?

Common challenges to maintaining positive cash flow include delayed receivables, high operational costs, seasonal fluctuations in revenue, and unexpected expenses. Businesses need to address these challenges through effective cash flow management and financial planning.

4. How does positive cash flow impact a company’s ability to grow?

Positive cash flow impacts a company’s ability to grow by providing the financial resources needed for expansion, innovation, and strategic investments. It allows businesses to capitalize on opportunities, invest in new projects, and enhance their competitive position in the market.

Conclusion

The benefits of positive cash flow are profound and multifaceted. It not only ensures that a business can meet its immediate financial obligations but also provides the foundation for long-term growth and stability.

By maintaining a positive cash flow, companies can invest in their operations, manage debt effectively, and enhance investor confidence. It’s essential for businesses to focus on optimizing their cash flow to support ongoing success and navigate the complexities of the financial landscape.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.