The optimize cash flow is essential for maintaining a healthy financial position and ensuring business sustainability. Effective cash flow management helps businesses meet their operational needs.

It invests in growth opportunities, and manages financial risks. It involves implementing strategies to improve cash inflows, control cash outflows, and manage working capital efficiently.

How Can Cash Flow Be Improved?

The process of improving cash flow involves several key steps

- Improve Receivables Collection

The timely collection of accounts receivable enhances cash inflows. Implementing efficient invoicing and follow-up procedures ensures that payments are received promptly.

- Streamline Payables

Managing accounts payable effectively by negotiating better payment terms with suppliers or scheduling payments strategically helps in retaining cash longer.

- Optimize Inventory Management

Maintaining optimal inventory levels reduces cash tied up in unsold goods. Implementing inventory management techniques such as just-in-time (JIT) can improve cash flow.

- Enhance Revenue Generation

Increasing sales and diversifying revenue streams can boost cash inflows. Effective marketing and sales strategies play a crucial role in revenue enhancement.

How Do You Manage Cash Flow Efficiently?

Efficient cash flow management involves several practices

- Regular Cash Flow Forecasting

Creating regular cash flow forecasts helps anticipate cash needs and manage cash flow proactively. Accurate forecasting supports better financial planning and decision-making.

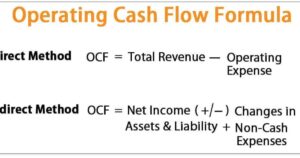

- Monitor Cash Flow Statements

Regularly reviewing cash flow statements provides insights into cash inflows and outflows. This helps in identifying trends and potential cash flow issues early.

- Control Overhead Costs

Reducing unnecessary overhead costs and improving operational efficiency contributes to better cash flow. Regular expense reviews help in identifying areas for cost savings.

- Maintain Cash Reserves

Building and maintaining cash reserves provides a cushion for unexpected expenses and fluctuations in cash flow, ensuring financial stability.

Which Strategy Is a Way to Improve Cash Flow?

Several strategies can improve cash flow, including

- Accelerate Receivables

Implementing strategies to speed up the collection of receivables, such as offering discounts for early payments or using electronic invoicing, improves cash flow.

- Extend Payables

Negotiating extended payment terms with suppliers allows businesses to retain cash longer still meeting their obligations.

- Optimize Pricing Strategies

Reviewing and adjusting pricing strategies can increase revenue and improve cash flow. Offering promotions or bundling products can also enhance sales.

- Reduce Inventory Levels

Minimizing excess inventory reduces cash tied up in stock and improves cash flow. Regular inventory reviews help in maintaining optimal stock levels.

How Can a Company Optimize Its Cash Management?

Optimizing cash management involves several key practices

- Implement Cash Management Systems

Using cash management systems and tools helps in tracking cash flows, managing accounts, and forecasting cash needs more effectively.

- Improve Cash Flow Visibility

Enhancing visibility into cash flows through regular reporting and analysis helps in making informed financial decisions and managing cash more efficiently.

- Utilize Short-Term Financing

Accessing short-term financing options, such as lines of credit, can provide additional cash flow during periods of need without long-term commitments.

- Manage Working Capital

Efficient management of working capital, including inventory, receivables, and payables, helps in optimizing cash flow and ensuring financial flexibility.

The Role of Cash Flow Forecasting

The creation of cash flow forecasts is crucial for optimizing cash flow

- Predict Cash Needs

Forecasting helps predict future cash needs based on anticipated inflows and outflows, enabling businesses to plan and manage cash more effectively.

- Identify Cash Shortages

Regular forecasts help identify potential cash shortages early, allowing businesses to take corrective actions such as securing additional financing or adjusting expenses.

- Support Financial Planning

Optimize cash flow forecasts support strategic financial planning by providing insights into cash requirements for investments, operations, and growth initiatives.

- Improve Decision-Making

Forecasting provides valuable information for making informed financial decisions, such as timing of expenditures and allocation of resources.

Enhancing Cash Flow Through Revenue Management

Effective revenue management contributes to cash flow optimization

- Dynamic Pricing

Implementing dynamic pricing strategies based on market conditions and customer demand can maximize revenue and improve cash flow.

- Diversify Revenue Streams

Expanding revenue streams through new products, services, or markets reduces dependence on a single source and enhances cash flow stability.

- Regular Sales Reviews

Analyzing sales performance and adjusting strategies accordingly helps in optimizing revenue generation and cash flow.

- Customer Segmentation

Understanding customer segments and tailoring revenue strategies to different groups can increase sales and improve cash flow.

Controlling Cash Outflows

Effective management of cash outflows is essential for optimizing cash flow

- Negotiate Payment Terms

Negotiating favorable payment terms with suppliers can help extend payment periods and manage cash flow better.

- Reduce Fixed Costs

Identifying and reducing fixed costs, such as rent or utilities, can free up cash for other uses and improve cash flow.

- Implement Budgeting Controls

Establishing and adhering to budgets helps control spending and manage cash flow more effectively.

- Monitor Expense Trends

Regularly reviewing expense trends helps in identifying areas where cost savings can be achieved, contributing to better cash flow management.

Leveraging Technology for Cash Management

Technology plays a vital role in optimizing cash management

- Cash Flow Management Software

Utilizing cash flow management software provides tools for tracking and forecasting cash flows, improving accuracy and efficiency.

- Automated Payments

Implementing automated payment systems reduces administrative costs and ensures timely payments, improving cash flow management.

- Data Analytics

Using data analytics for cash flow analysis helps in identifying patterns, trends, and opportunities for optimization.

- Integration

Integrating cash management systems with other financial systems, such as accounting and inventory management, provides a comprehensive view of cash flows and enhances management.

Managing Cash Flow During Growth

Effective cash flow management is crucial during periods of growth

- Plan for Expansion Costs

Anticipating and planning for the costs associated with business expansion helps manage cash flow effectively.

- Secure Financing

Accessing financing options, such as loans or equity investment, provides additional cash flow to support growth initiatives.

- Monitor Cash Flow Closely

Regular monitoring of cash flow during growth periods helps in managing increased expenses and ensuring financial stability.

- Adjust Cash Flow Strategies

Optimize cash flow strategies to align with growth objectives ensures that cash flow remains positive and supports business expansion.

The Impact of Seasonality on Cash Flow

Seasonal fluctuations can impact cash flow

- Plan for Seasonality

Developing strategies to manage seasonal cash flow variations, such as building cash reserves during peak seasons, helps in maintaining stability during off-seasons.

- Adjust Inventory Levels

Managing inventory levels based on seasonal demand ensures that cash is not tied up in excess stock.

- Flexible Financing

Utilizing flexible financing options can provide additional cash flow during seasonal downturns.

- Review Seasonal Performance

Regularly reviewing seasonal performance helps in making informed decisions and optimizing cash flow throughout the year.

Frequently Asked Questions

Q1. How can cash flow be improved?

Cash flow can be improved by accelerating receivables, managing payables effectively, optimizing inventory levels, and enhancing revenue generation strategies.

Q2. How do you manage cash flow efficiently?

Efficient cash flow management involves regular cash flow forecasting, monitoring cash flow statements, controlling overhead costs, and maintaining cash reserves.

Q3. Which strategy is a way to improve cash flow?

Strategies to improve cash flow include accelerating receivables, extending payables, optimizing pricing strategies, and reducing inventory levels.

Q4. How can a company optimize its cash management?

A company can optimize its cash management by implementing cash management systems, improving cash flow visibility, utilizing short-term financing, and managing working capital effectively.

Conclusion

Optimize cash flow is essential for maintaining a healthy financial position and ensuring business success. By implementing effective strategies for improving optimize cash flow, managing cash efficiently, and optimizing cash management.

Businesses can enhance their financial stability and support growth initiatives. Regular monitoring, forecasting, and strategic planning contribute to better cash flow management and long-term success.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.