Improve cash flow of a small business is crucial for its survival and growth. It represents the amount of money moving in and out of the business, affecting everything from daily operations to long-term investments.

Improve cash flow management ensures that a business can meet its obligations, seize opportunities, and avoid financial difficulties. The ability to maintain a healthy cash flow is often the difference between success and failure for many small businesses.

How Can a Small Business Improve Cash Flow?

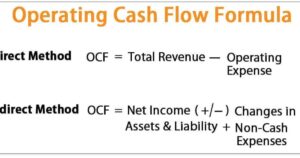

The key to improving cash flow lies in adopting strategies that enhance the inflow of cash and manage outflows efficiently. The first step is to closely monitor and analyze cash flow statements to identify patterns and potential issues.

The implementation of effective invoicing practices, such as issuing invoices promptly and offering incentives for early payments, can significantly boost cash flow.

Additionally, businesses can explore various financing options like short-term loans or lines of credit to manage cash flow gaps.

How Do Small Businesses Deal with Cash Flow Problems?

The strategies to address cash flow problems include improving collection processes and negotiating better payment terms with suppliers. The introduction of strict credit control measures ensures that invoices are paid on time.

The establishment of a cash reserve or emergency fund provides a buffer for unexpected expenses. The reevaluation of pricing strategies and cost structures can also help in managing cash flow issues effectively.

Which Strategy Is a Way to Improve Cash Flow?

The adoption of a cash flow forecasting strategy is an effective way to improve cash flow. The use of forecasting tools and software helps in predicting future cash flow needs based on historical data and market trends.

The implementation of a robust budget that aligns with cash flow forecasts allows businesses to plan and allocate resources efficiently. The regular review and adjustment of the budget based on actual performance ensure that the business remains on track.

What Are Two Ways a Business Can Improve Its Cash Flow by Slowing Down Outflow?

The first way to improve cash flow by slowing down outflow is through effective inventory management. The reduction of excess inventory helps in freeing up cash that would otherwise be tied up in unsold goods.

The second way involves negotiating extended payment terms with suppliers. The extension of payment deadlines provides additional time to manage cash flow, allowing businesses to use available cash for other critical needs.

Implementing Efficient Invoicing Practices

The implementation of efficient invoicing practices plays a significant role in improving cash flow. The use of automated invoicing systems ensures that invoices are sent promptly and follow up on overdue payments.

The inclusion of clear payment terms and conditions in invoices helps in setting expectations and reducing payment delays. The establishment of a system for regular invoicing and collections further enhances cash flow management.

Exploring Financing Options

The exploration of financing options provides businesses with additional resources to manage cash flow. The use of short-term loans or lines of credit offers flexibility in handling temporary cash flow shortages.

The consideration of alternative financing methods, such as crowdfunding or invoice factoring, can also provide immediate cash flow support. The careful evaluation of financing terms and costs ensures that the chosen option aligns with the business’s financial goals.

Optimizing Expense Management

The optimization of expense management involves identifying and reducing unnecessary expenditures. The implementation of cost-cutting measures, such as renegotiating contracts or outsourcing non-core functions, helps in controlling expenses.

The use of budgeting tools and expense tracking software enables businesses to monitor and manage expenses effectively. The regular review of expenses and adjustments based on cash flow needs ensures financial stability.

Enhancing Revenue Streams

The enhancement of revenue streams contributes to improved cash flow by increasing the inflow of cash. The exploration of new markets or product lines can diversify revenue sources and reduce dependence on a single stream.

The implementation of effective sales and marketing strategies helps in attracting new customers and increasing sales. The focus on customer retention and upselling also boosts revenue and supports cash flow management.

Managing Debts and Liabilities

The management of debts and liabilities is essential for maintaining a healthy cash flow. The regular review of outstanding debts and the development of a repayment plan helps in managing liabilities effectively.

The negotiation of better terms with creditors, such as lower interest rates or extended repayment periods, can reduce financial strain. The prioritization of debt repayment based on interest rates and financial impact ensures that cash flow is managed efficiently.

Leveraging Technology for Cash Flow Management

The leverage of technology plays a significant role in enhancing cash flow management. The use of cash flow management software provides real-time insights into cash flow patterns and helps in making informed decisions.

The integration of financial tools and platforms streamlines invoicing, expense tracking, and forecasting processes. The adoption of technology-driven solutions ensures accurate and efficient cash flow management.

Building Strong Relationships with Suppliers and Customers

The building of strong relationships with suppliers and customers contributes to improved cash flow. The establishment of trust and open communication with suppliers can lead to better payment terms and favorable conditions.

The development of long-term relationships with customers encourages repeat business and timely payments. The focus on customer satisfaction and supplier partnerships enhances overall cash flow stability.

Monitoring and Adjusting Cash Flow Strategies

The monitoring and adjustment of cash flow strategies are crucial for ongoing financial health. The regular review of cash flow reports and performance metrics helps in identifying trends and potential issues.

The adjustment of strategies based on performance and market changes ensures that cash flow management remains effective. The proactive approach to monitoring and adjusting strategies supports long-term financial stability.

Seeking Professional Advice

The seeking of professional advice from financial experts can provide valuable insights into cash flow management. The consultation with accountants or financial advisors helps in developing tailored cash flow strategies based on the business’s specific needs.

The expertise of professionals in financial planning and analysis can enhance cash flow management and overall business performance.

Ensuring Compliance with Financial Regulations

The ensuring of compliance with financial regulations is essential for maintaining cash flow integrity. The adherence to accounting standards and tax regulations helps in avoiding legal issues and financial penalties.

The implementation of internal controls and audit processes ensures accurate financial reporting and cash flow management. The regular review of compliance requirements and updates helps in maintaining financial health.

Frequently Asked Questions

1. What is the best way to improve cash flow for a small business?

The best way to improve cash flow is by implementing efficient invoicing practices, managing expenses effectively, and exploring financing options. Regular cash flow forecasting and budgeting also play a crucial role in maintaining financial stability.

2. How can small businesses handle cash flow problems?

Small businesses can handle cash flow problems by improving collection processes, negotiating better payment terms with suppliers, and establishing a cash reserve. Reevaluating pricing strategies and cost structures can also help in addressing cash flow issues.

3. What are some strategies to enhance cash flow?

Strategies to enhance cash flow include adopting cash flow forecasting, optimizing inventory management, and leveraging technology for financial management. Building strong relationships with suppliers and customers and seeking professional advice are also effective strategies.

4. How can slowing down outflows improve cash flow?

Slowing down outflows can improve cash flow by reducing the amount of cash tied up in inventory and extending payment terms with suppliers. Effective inventory management and negotiation of better payment terms help in freeing up cash for other needs.

Conclusion

The improvement of cash flow for small businesses involves a combination of effective strategies and practices. By adopting efficient invoicing, exploring financing options, optimizing expense management, and leveraging technology, businesses can enhance their cash flow.

The focus on building strong relationships with suppliers and customers, monitoring cash flow regularly, and seeking professional advice further supports financial stability. Implementing these strategies ensures that small businesses can navigate financial challenges and achieve long-term success.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.