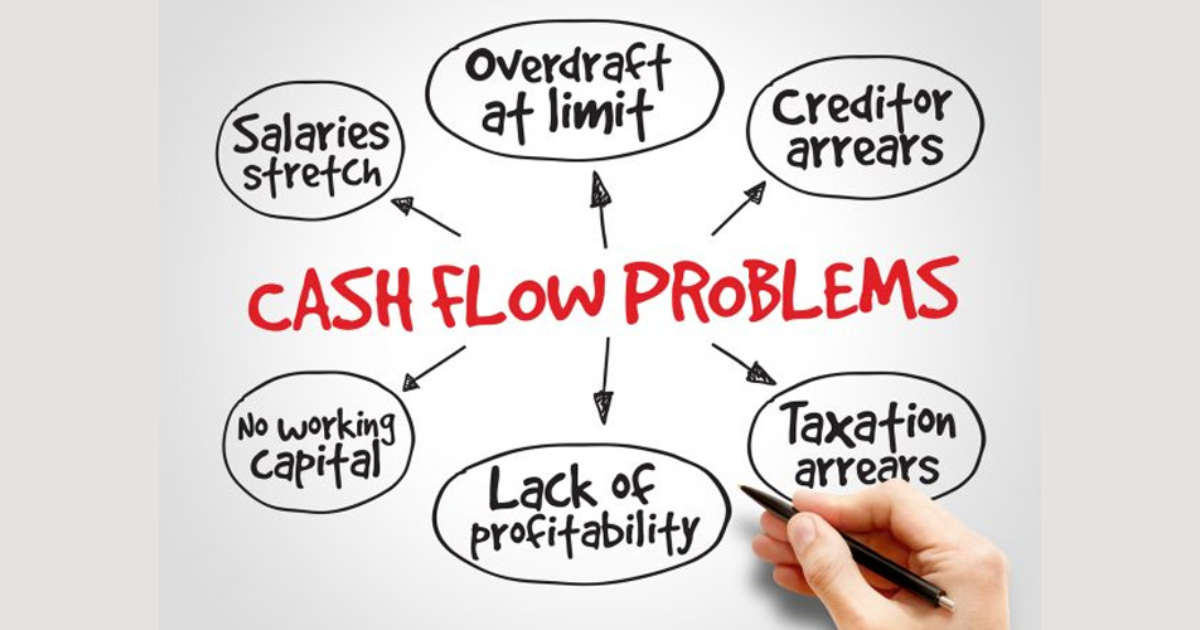

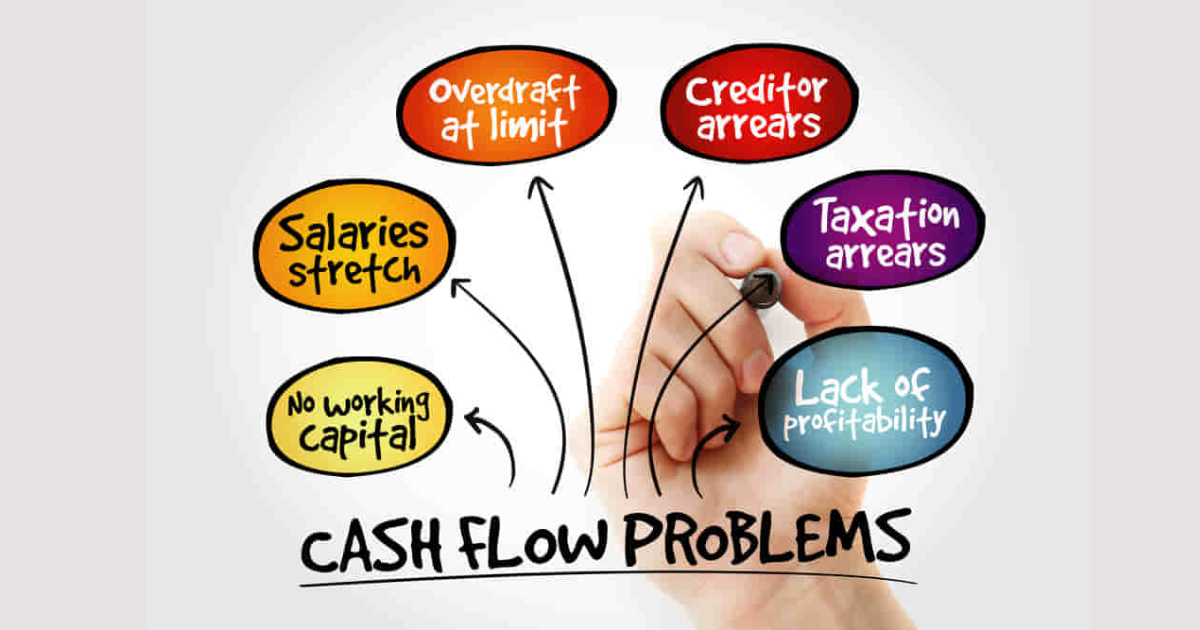

The success of any business heavily relies on managing its cash flow effectively. Cash flow problems are one of the primary reasons many businesses struggle, leading to difficulties in meeting financial obligations and sustaining operations. This article aims to uncover the common causes of cash flow problems, explore mistakes businesses make, and provide practical solutions to overcome these challenges.

What Are the Most Common Causes of Cash Flow Problems?

The root causes of cash flow problems are varied, but some are more common than others. The most frequent cause is delayed payments from clients or customers. When businesses extend credit to their customers but fail to collect payments promptly, it creates a cash flow gap. The lack of effective credit control can turn into a significant problem over time.

Another common cause is overstocking. Businesses that invest too much capital in inventory might find that their money is tied up in unsold goods, restricting their available cash for operational expenses.

Furthermore, overspending on expenses, such as marketing or new equipment, without a proportional increase in revenue, can lead to cash shortages. Lastly, seasonal fluctuations can also impact cash flow, especially in industries like retail and tourism, where income is not evenly distributed throughout the year.

What Are Common Errors in Cash Flow?

The failure to forecast cash flow accurately is a major mistake that many businesses make. Without a clear projection of expected inflows and outflows, it becomes challenging to anticipate future cash needs. Another common error is neglecting to account for upcoming expenses, such as taxes or loan repayments, which can catch business owners off guard.

Poor management of accounts receivable is another frequent mistake. Allowing overdue invoices to pile up without following up can severely disrupt cash flow. Not securing adequate funding or having access to a line of credit can leave a business vulnerable during times of cash shortages.

Businesses that fail to build a cash reserve for emergencies often find themselves struggling when unexpected expenses arise. Lastly, misaligning payment terms with suppliers and customers can create timing issues, where businesses need to pay suppliers before they receive payment from their customers.

What is an Example of a Business with Cash Flow Problems?

The restaurant industry serves as a prime example of a sector often plagued by cash flow problems. Restaurants typically operate on tight margins, and any disruption in cash flow can have immediate consequences. For instance, restaurants must pay for their ingredients and supplies upfront, but they only receive payments after customers have dined. This imbalance can cause difficulties in covering payroll, rent, and other operational costs.

Many restaurants extend credit to corporate clients for catering services, leading to delayed payments. If customers take longer than expected to settle their bills, the restaurant may face a cash crunch. Seasonal fluctuations, such as a decrease in customer traffic during certain months, can also exacerbate cash flow challenges for restaurants.

Which of the Following is a Common Reason for Cash Flow Problems?

One of the most common reasons for cash flow problems is the mismanagement of accounts receivable. When businesses fail to collect payments on time, it disrupts the flow of cash needed to cover expenses. This issue can be further compounded by offering overly generous payment terms to customers or not following up on overdue invoices.

Another reason is poor financial planning. Businesses that don’t create a cash flow forecast or fail to budget for future expenses often encounter cash shortages. Businesses that expand too quickly without securing the necessary capital or managing their working capital efficiently are also prone to cash flow problems. Rapid growth can lead to increased expenses, such as hiring more staff or purchasing additional inventory, which, without sufficient cash inflows, can strain the business.

How Can Poor Inventory Management Lead to Cash Flow Issues?

Inventory management is crucial for maintaining healthy cash flow. The overstocking of products ties up cash in unsold goods, which means that money that could have been used for operational expenses is now inaccessible. Overstocking also increases storage costs and may lead to inventory becoming obsolete, resulting in losses.

On the other hand, understocking can also create problems. If a business does not have enough inventory to meet customer demand, it risks losing sales and damaging its reputation. Striking a balance between having sufficient inventory and not overinvesting in stock is critical for maintaining cash flow.

Why Is Cash Flow Forecasting Important for Businesses?

Cash flow forecasting is essential for businesses to anticipate future financial needs and prevent cash shortages. A well-prepared cash flow forecast provides a detailed projection of expected cash inflows and outflows, allowing businesses to plan accordingly. It helps identify periods where cash might be tight, enabling business owners to take proactive measures, such as securing financing or cutting costs.

It also aids in making informed decisions, such as whether to invest in new equipment, hire additional staff, or expand operations. Without a cash flow forecast, businesses are essentially flying blind, making them more susceptible to financial surprises that could disrupt operations.

How Can Delayed Payments Affect a Business’s Cash Flow?

Delayed payments from customers are one of the most common cash flow issues businesses face. When customers don’t pay on time, it creates a gap in the business’s cash flow, making it difficult to cover expenses such as payroll, rent, and supplier payments. This delay can force businesses to dip into their cash reserves or seek short-term financing, both of which can be costly.

The ripple effect of delayed payments can also strain relationships with suppliers. If a business is unable to pay its suppliers on time due to a lack of cash, it may face penalties, damaged credit, or even disrupted supply chains. Therefore, businesses must implement effective credit control procedures to minimize the impact of delayed payments on cash flow.

What Role Does Seasonality Play in Cash Flow Problems?

Seasonal businesses often experience cash flow fluctuations due to variations in demand throughout the year. For example, a retailer might see a surge in sales during the holiday season, but experience a lull during the off-season. Without proper cash flow management, businesses may struggle to cover expenses during slower periods.

To address seasonality issues, businesses need to plan ahead by building up cash reserves during peak periods to sustain them during the off-season. They should also consider diversifying their product or service offerings to generate revenue throughout the year.

How Can Rapid Expansion Cause Cash Flow Problems?

Rapid expansion can strain a business’s cash flow, especially if growth is not accompanied by adequate financial planning. Expanding operations often requires significant upfront investments, such as hiring new staff, purchasing additional inventory, or opening new locations. If the business does not generate enough revenue quickly enough to cover these expenses, it may face cash shortages.

Expanding too quickly can lead to inefficiencies, such as increased overhead costs and operational challenges. Businesses need to ensure they have sufficient cash reserves and access to financing to support growth without compromising their cash flow.

What Impact Does Poor Financial Management Have on Cash Flow?

Poor financial management is a major contributor to cash flow problems. Businesses that do not keep accurate records or fail to monitor their finances regularly are more likely to encounter cash flow issues. For example, failing to track expenses can lead to overspending, while not keeping an eye on accounts receivable can result in delayed payments.

Inadequate financial planning, such as not budgeting for upcoming expenses or failing to forecast cash flow, can also lead to cash shortages. Businesses need to implement strong financial management practices, including regular financial reviews, to ensure they have the cash flow necessary to sustain operations.

How Can Businesses Avoid Cash Flow Problems?

Avoiding cash flow problems requires proactive management and planning. Businesses should create a cash flow forecast to anticipate future financial needs and identify potential cash shortages. Implementing effective credit control procedures, such as setting clear payment terms and following up on overdue invoices, can help prevent delayed payments from disrupting cash flow.

Additionally, businesses should build up cash reserves to cover unexpected expenses or periods of reduced revenue. Managing expenses carefully, negotiating favorable payment terms with suppliers, and securing access to financing can also help businesses avoid cash flow problems.

What Are the Benefits of Having a Cash Reserve?

Having a cash reserve provides businesses with a financial safety net to cover unexpected expenses or periods of reduced revenue. Cash reserves can be used to bridge the gap during cash flow shortages, such as when customers delay payments or when sales decline due to seasonality.

A cash reserve also provides businesses with the flexibility to take advantage of opportunities, such as investing in new equipment or expanding operations, without risking cash flow. By maintaining a cash reserve, businesses can navigate financial challenges more effectively and ensure their long-term sustainability.

How Can Access to Financing Help with Cash Flow?

Access to financing, such as a line of credit or a business loan, can provide businesses with the cash flow they need to cover expenses during periods of financial strain. Financing can be used to bridge cash flow gaps caused by delayed payments, seasonal fluctuations, or unexpected expenses.

Having access to financing can also help businesses take advantage of growth opportunities, such as expanding operations or investing in new equipment, without jeopardizing their cash flow. However, businesses should use financing carefully and ensure they have a plan for repaying any borrowed funds.

How Can Effective Credit Control Improve Cash Flow?

Effective credit control is essential for maintaining healthy cash flow. Businesses should establish clear payment terms with customers and follow up on overdue invoices promptly. Implementing a credit control policy can help reduce the risk of delayed payments, which can disrupt cash flow.

Businesses should regularly review their accounts receivable and take action to recover any outstanding debts. By managing credit effectively, businesses can ensure they receive payments on time and maintain a steady cash flow.

Frequently Asked Questions

1. What are the main causes of cash flow problems?

The main causes include delayed customer payments, overstocking, overspending, and seasonal fluctuations.

2. How can businesses prevent cash flow problems?

Businesses can prevent cash flow problems by creating cash flow forecasts, managing expenses, implementing effective credit control, and maintaining cash reserves.

3. How do delayed payments affect cash flow?

Delayed payments create a gap in cash flow, making it difficult to cover operational expenses like payroll and rent, and may lead to strained supplier relationships.

4. What is the importance of cash flow forecasting?

Cash flow forecasting helps businesses anticipate future financial needs, allowing them to plan for expenses and avoid cash shortages.

Conclusion

Managing cash flow is critical for the success and sustainability of any business. By understanding the common causes of cash flow problems and implementing effective financial management practices, businesses can navigate challenges and ensure they have the cash flow necessary to meet their obligations and pursue growth opportunities. Planning, forecasting, and proactive management are the keys to overcoming cash flow problems and building a financially healthy business.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.