The cash flow investing is a critical component of a company’s cash flow statement. It reflects the cash transactions related to the acquisition and disposal of long-term assets, such as property, equipment, and investments. This section of the cash flow statement provides insights into how a company is investing its capital to support its growth and strategic goals.

What Is the Cash Flow from Investing Ratio?

The cash flow from investing ratio measures the extent to which a company’s cash flow from investing activities covers its capital expenditures. It is calculated using the following formula

Cash Flow from Investing Ratio=Cash Flow from Investing ActivitiesCapital Expenditures\text{Cash Flow from Investing Ratio} = \frac{\text{Cash Flow from Investing Activities}}{\text{Capital Expenditures}}Cash Flow from Investing Ratio=Capital ExpendituresCash Flow from Investing Activities

This ratio helps investors and analysts assess whether a company is effectively managing its investments relative to its spending on new assets. A higher ratio indicates that a company is generating sufficient cash from its investments to fund its capital expenditures.

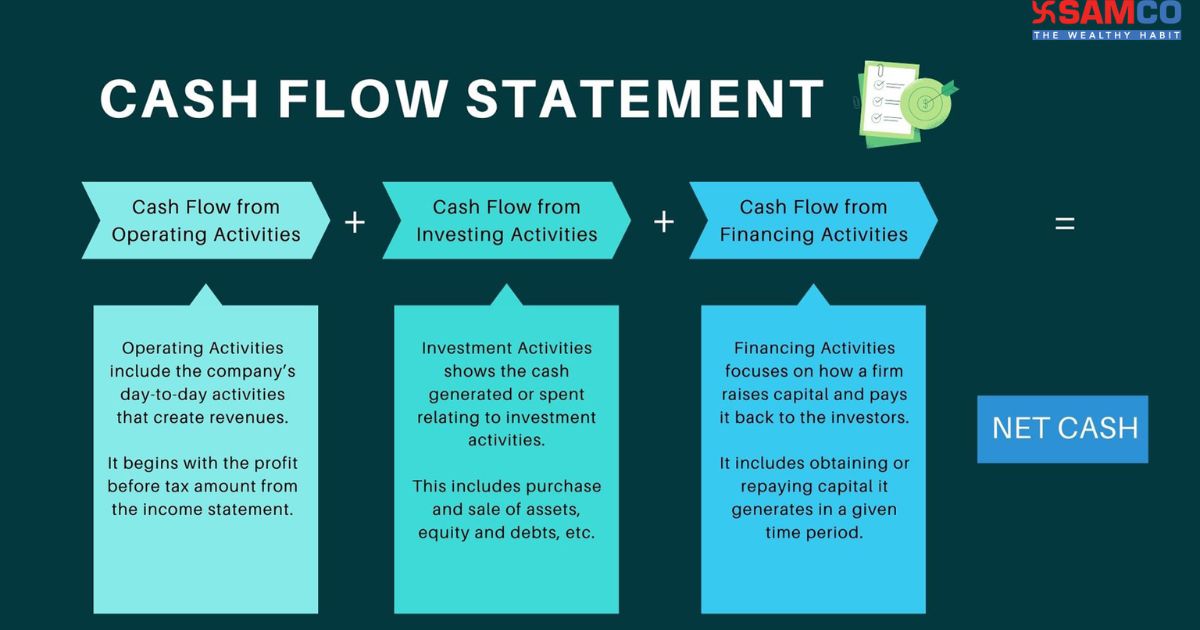

What Is Cash Flow from Investing vs Financing?

The cash flow from investing and financing activities are two distinct sections of the cash flow statement

- Cash Flow from Investing

This section records cash transactions related to the purchase and sale of long-term assets and investments. Examples include buying or selling equipment, acquiring new properties, or investing in other companies.

- Cash Flow from Financing

This section includes cash transactions related to raising or repaying capital. It covers activities such as issuing or repurchasing shares, taking on or repaying debt, and paying dividends.

The key difference is that investing cash flows focus on the company’s use of funds for growth and expansion, financing cash flows relate to how the company raises and manages its capital.

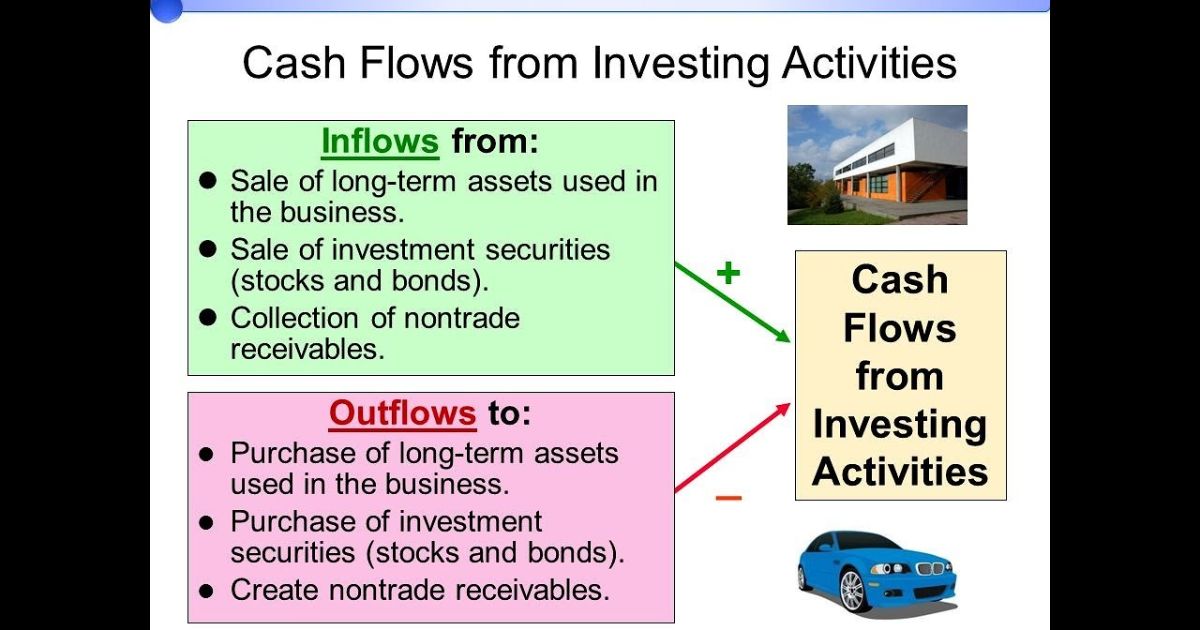

What Is Cash Outflow from Investing?

Cash outflow from investing represents the money spent on acquiring long-term assets or investments. This includes expenditures on

- Property, Plant, and Equipment

Purchases of new facilities, machinery, or technology.

- Investments

Buying shares or stakes in other companies or joint ventures.

- Capital Expenditures

Spending on upgrading or maintaining existing assets.

High cash outflows from investing can indicate a company is expanding its operations or investing in future growth. However, it is crucial to assess whether these investments will generate adequate returns.

What Is the Cash Flow Statement for Investors?

The cash flow statement is an essential financial document that provides insights into a company’s cash inflows and outflows over a specific period. For investors, this statement is valuable because it.

- Shows Cash Flow Sources

It details where the company’s cash is coming from, whether from operations, investing activities, or financing.

- Reveals Investment Trends

It highlights how the company is investing its funds, including acquisitions, capital expenditures, and other investments.

- Indicates Financial Health

It provides information on the company’s ability to generate cash, meet its financial obligations, and fund future growth.

Analyzing Cash Flow from Investing Activities

- Review Investment Patterns

Analyzing the patterns of cash flows from investing activities can provide insights into a company’s growth strategy and asset management.

- Assess Return on Investments

Evaluating the returns generated from investments helps determine the effectiveness of the company’s capital allocation.

- Monitor Capital Expenditures

Regular review of capital expenditures helps in understanding how the company is investing in its infrastructure and long-term assets.

The Impact of Positive Cash Flow from Investing

Positive cash flow from investing indicates that a company is selling assets or investments and generating cash. This situation might occur if

- Assets Are Being Sold

The company is divesting non-core assets or property.

- Investment Returns

Investments are yielding returns or being liquidated.

Positive cash flow from investing can provide flexibility for future investments or financial stability.

The Impact of Negative Cash Flow from Investing

Negative cash flow from investing occurs when a company spends more on investments than it generates from asset sales. This situation may result from

- Capital Expenditures

Large investments in new projects, equipment, or facilities.

- Acquisitions

Purchasing other businesses or assets.

Negative cash flow from investing might signal significant investments in growth, it is essential to evaluate whether these investments are expected to generate future returns.

Cash Flow from Investing and Company Growth

The cash flow from investing plays a crucial role in supporting company growth by

- Funding Expansion

Investing in new projects or facilities can drive business expansion and increase revenue potential.

- Upgrading Technology

Acquiring advanced technology or equipment improves efficiency and competitiveness.

- Strategic Acquisitions

Purchasing other companies or assets can provide new revenue streams and market opportunities.

Evaluating Investment Effectiveness

Investors should assess the effectiveness of cash flows from investing by

- Calculating ROI

Evaluating the return on investment for each major expenditure to ensure it meets expectations.

- Benchmarking Performance

Comparing investment performance against industry standards or competitors.

- Analyzing Long-Term Impact

Considering the long-term benefits and strategic value of investments.

Integrating Cash Flow from Investing with Financial Analysis

Integrating cash flow investing with other financial metrics provides a comprehensive view of a company’s financial health. Key integrations include

- Comparing with Operating Cash Flow

Understanding how investing activities relate to cash flow from operations.

- Analyzing Profit Margins

Assessing how investments impact overall profitability and cost management.

- Reviewing Debt Levels

Evaluating how investments are financed and their impact on debt ratios.

Monitoring Changes in Cash Flow from Investing

Monitoring changes in cash flow investing helps identify trends and make informed decisions. Changes may result from

- Increased Investments

Significant new investments may indicate expansion or modernization efforts.

- Asset Sales

Selling assets can provide immediate cash but may impact long-term operations.

Common Mistakes in Managing Cash Flow from Investing

Common mistakes include

- Overinvesting

Spending too much on capital expenditures without adequate return analysis.

- Neglecting Cash Flow Impact

Failing to consider how investing activities affect overall cash flow.

Frequently Asked Questions

Q1. What is the cash flow from investing ratio?

The cash flow investing ratio measures how well a company’s cash flow from investing activities covers its capital expenditures. It is calculated by dividing cash flow from investing activities by capital expenditures.

Q2. What is the difference between cash flow from investing and financing?

Cash flow from investing involves cash transactions related to long-term assets and investments, cash flow from financing involves cash transactions related to raising or repaying capital, such as issuing shares or taking on debt.

Q3. What constitutes cash outflow from investing?

Cash outflow from investing includes expenditures on acquiring long-term assets, such as property, equipment, and investments, as well as capital expenditures for upgrading or maintaining existing assets.

Q4. What information does the cash flow statement provide for investors?

The cash flow investing statement provides insights into a company’s cash inflows and outflows, detailing sources of cash, investment activities, and financing activities. It helps investors assess financial health, investment strategies, and capital management.

Conclusion

Understanding cash flow investing is essential for evaluating a company’s financial health and growth prospects. It reflects how a company allocates its resources for long-term assets and investments, impacting both its strategic direction and financial stability. By analyzing cash flow investing, investors can gain insights into a company’s growth strategy, investment effectiveness, and overall financial management.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.