In today’s dynamic financial landscape, understanding the relationship between cash flow impact and financial stability is essential for businesses and individuals alike. The cash flow impact on financial stability is profound and multifaceted.This will explore various dimensions of how cash flow affects financial performance, stability, and overall practice finances, providing valuable insights for effective financial management.

How Does Cash Flow Affect Financial Performance?

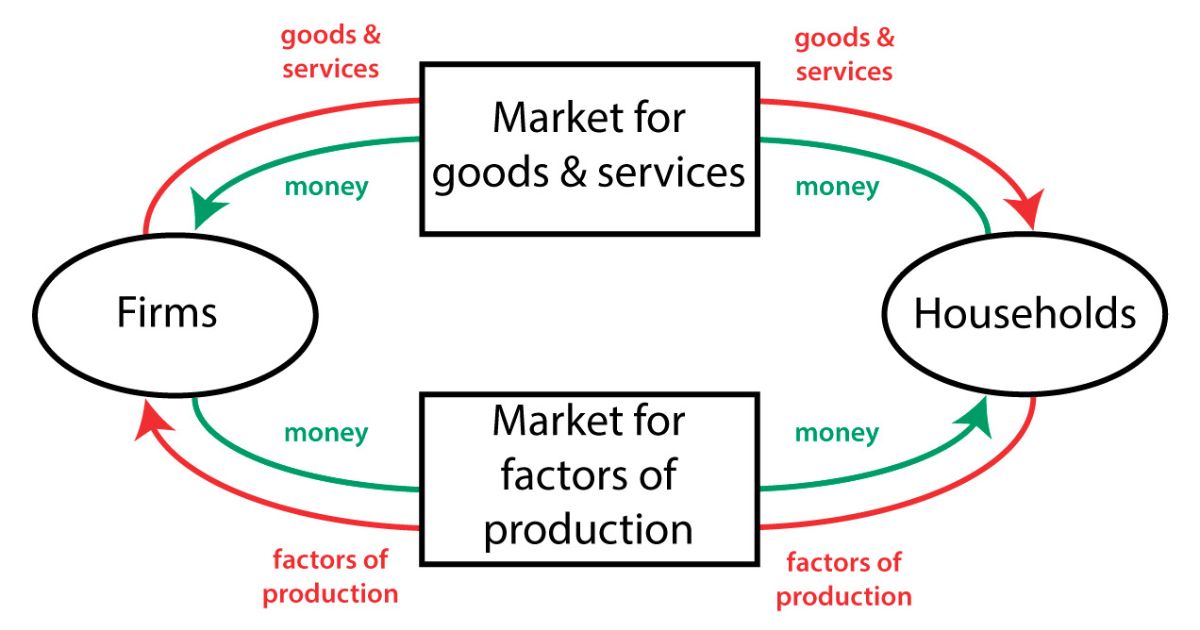

The influence of cash flow on financial performance cannot be overstated. It is the lifeblood of any organization, impacting its ability to operate smoothly and meet obligations. Positive cash flow allows a business to cover its expenses, invest in growth opportunities, and maintain a healthy financial position.

Conversely, negative cash flow impact can lead to financial strain, affecting the company’s ability to pay bills, invest in new projects, and sustain operations. The financial performance of a business is closely tied to its cash flow, as it determines the company’s capacity to generate profits and maintain liquidity.

Do Positive Cash Flows Always Mean Financial Stability?

It is important to recognize that positive cash flows do not always guarantee financial stability. The quality of cash flow is just as crucial as its quantity. Positive cash flow can sometimes be driven by short-term strategies or irregular sources, which may not reflect the company’s overall financial health.

For example, a business may experience a cash flow boost from a one-time sale or external funding, but this does not necessarily indicate long-term stability. Financial stability requires a consistent and predictable cash flow, coupled with effective management practices and a strong financial foundation.

What Impact Does Cash Flow Have on Practice Finances?

The impact of cash flow on practice finances is particularly significant for professionals such as doctors, lawyers, and consultants. Effective cash flow management ensures that practices can cover operational costs, invest in necessary resources, and manage unexpected expenses.

For instance, a medical practice needs a steady cash flow to maintain equipment, pay staff salaries, and handle patient care costs. Poor cash flow management in such practices can lead to disruptions in service delivery, financial stress, and potentially jeopardize the practice’s long-term viability. Proper cash flow strategies are essential for maintaining financial health and operational efficiency in these fields.

Why Is Cash Flow Important in Finance?

The importance of cash flow in finance lies in its role as a critical indicator of financial health. Cash flow provides insight into an organization’s ability to generate and manage liquidity, which is essential for meeting financial obligations and pursuing growth opportunities. Effective cash flow management helps in budgeting, forecasting, and planning.

It enabling businesses to make informed decisions and avoid financial pitfalls. Without a thorough understanding of cash flow, it is challenging to achieve financial stability and long-term success. Proper cash flow management is integral to financial planning and stability, influencing every aspect of financial decision-making.

The Role of Cash Flow in Financial Planning

The role of cash flow in financial planning is fundamental. It serves as the basis for budgeting and forecasting, allowing businesses to project future financial needs and allocate resources effectively.

By analyzing cash flow trends, organizations can identify potential issues before they become critical, ensuring that they have the necessary funds to cover expenses and invest in growth. Effective financial planning relies on accurate cash flow data to make strategic decisions, optimize operations, and maintain financial health.

Cash Flow vs. Profit: Understanding the Difference

The difference between cash flow and profit is crucial for financial stability. While profit represents the excess of revenue over expenses, cash flow reflects the actual movement of money in and out of a business.

It is possible for a business to be profitable but still experience cash flow problems if revenue is tied up in accounts receivable or if there are significant outflows. Understanding this distinction helps businesses manage their finances more effectively, ensuring that they can meet immediate obligations while pursuing long-term profitability.

Managing Cash Flow for Small Businesses

Managing cash flow is particularly challenging for small businesses, which often operate with limited resources and face fluctuating revenue streams. Effective cash flow management involves monitoring cash inflows and outflows, maintaining an adequate cash reserve, and implementing strategies to improve liquidity.

Small businesses can benefit from practices such as timely invoicing, expense tracking, and negotiating favorable payment terms with suppliers. By adopting these practices, small businesses can enhance their financial stability and navigate cash flow challenges more effectively.

The Impact of Seasonal Variations on Cash Flow

Seasonal variations can have a significant impact on cash flow, especially for businesses with fluctuating demand throughout the year. Understanding and planning for these variations is essential for maintaining financial stability.

Businesses should analyze historical cash flow data to identify seasonal trends and develop strategies to manage cash flow during peak and off-peak periods. This may involve building cash reserves during high-demand seasons and implementing cost-saving measures during slower periods to ensure consistent financial stability.

The Connection Between Cash Flow and Debt Management

The connection between cash flow and debt management is crucial for maintaining financial stability. Adequate cash flow ensures that a business can meet its debt obligations, including interest payments and principal repayments.

Poor cash flow management can lead to missed payments, increased debt, and financial stress. Effective debt management involves aligning debt repayment schedules with cash flow patterns, ensuring that the business can manage its obligations without compromising operational stability.

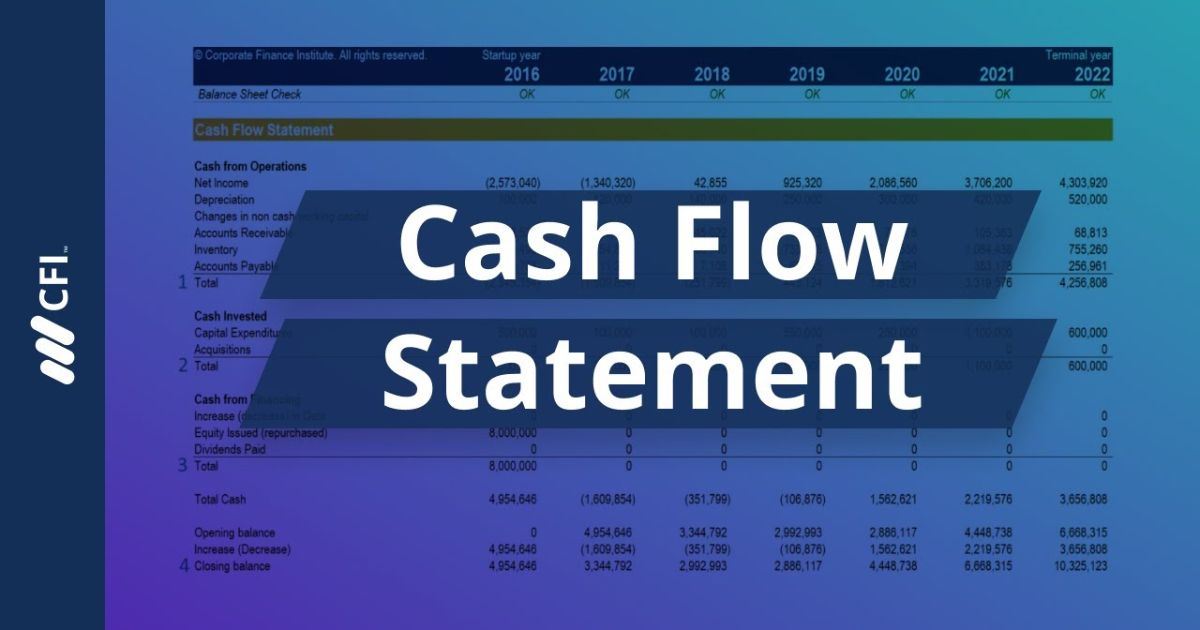

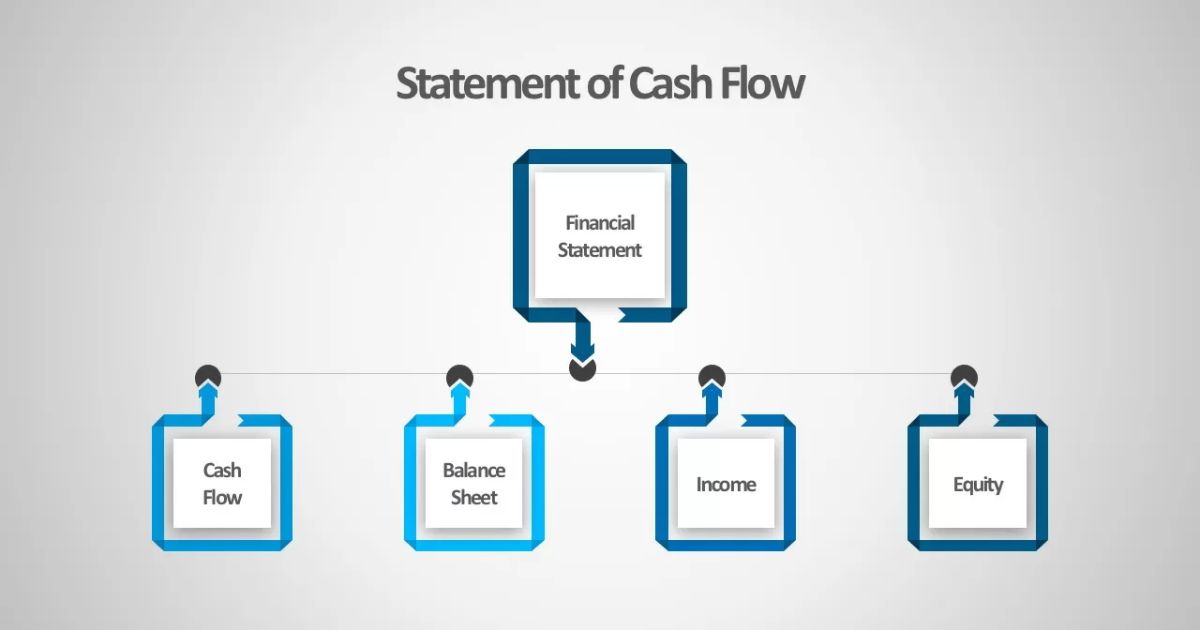

Using Cash Flow Statements for Financial Analysis

The use of cash flow statements for financial analysis provides valuable insights into a business’s financial health. Cash flow statements detail the sources and uses of cash, highlighting operating, investing, and financing activities.

By analyzing these statements, businesses can assess their liquidity, operational efficiency, and financial stability. Regular review of cash flow statements helps identify trends, monitor performance, and make informed decisions to enhance financial stability.

Strategies for Improving Cash Flow Management

Improving cash flow management involves implementing strategies to optimise cash inflows and outflows. Key strategies include enhancing invoicing processes, accelerating collections, managing inventory levels, and controlling expenses.

Businesses can also explore financing options such as lines of credit or factoring to bridge temporary cash flow gaps. By adopting these strategies, organisations can improve their cash flow position, support growth initiatives, and ensure long-term financial stability.

The Role of Technology in Cash Flow Management

The role of technology in cash flow management has grown significantly, providing tools and solutions to enhance financial oversight and efficiency. Accounting software, financial dashboards, and cash flow forecasting tools offer real-time visibility into cash flow patterns, automate financial processes, and facilitate better decision-making. Embracing technology helps businesses streamline cash flow management, reduce manual errors, and improve overall financial stability.

The Impact of Economic Conditions on Cash Flow

Economic conditions play a crucial role in influencing cash flow. Factors such as inflation, interest rates, and economic downturns can affect cash flow by altering revenue patterns, increasing costs, and impacting consumer spending.

Businesses must stay informed about economic trends and adjust their cash flow strategies accordingly to mitigate risks and maintain financial stability. Proactive management of cash flow in response to economic conditions is essential for sustaining operations and achieving long-term success.

Evaluating Cash Flow in Different Business Models

Evaluating cash flow in different business models requires an understanding of how various models impact cash flow dynamics. For instance, subscription-based businesses often experience steady cash inflows, while retail businesses may face seasonal fluctuations.

Analyzing cash flow patterns specific to the business model helps identify strengths, weaknesses, and opportunities for improvement. Tailoring cash flow management strategies to the unique characteristics of the business model enhances financial stability and operational efficiency.

Common Cash Flow Challenges and Solutions

Common cash flow challenges include delayed payments, high operational costs, and unexpected expenses. Addressing these challenges involves implementing effective cash flow management practices, such as improving invoicing processes, negotiating payment terms with suppliers, and maintaining a cash reserve.

Businesses can also explore financing options to address short-term cash flow gaps. By proactively managing these challenges, organizations can enhance their financial stability and achieve long-term success.

Frequently Asked Questions

Q1. What is the primary difference between cash flow and profit?

The primary difference between cash flow and profit is that cash flow represents the actual movement of money into and out of a business, while profit is the excess of revenue over expenses. Cash flow focuses on liquidity, whereas profit reflects overall financial performance.

Q2. How can small businesses improve their cash flow management?

Small businesses can improve cash flow management by implementing strategies such as timely invoicing, tracking expenses, managing inventory levels, and negotiating payment terms with suppliers. Additionally, maintaining a cash reserve and exploring financing options can help address cash flow challenges.

Q3. What role does technology play in cash flow management?

Technology plays a significant role in cash flow management by providing tools and solutions that enhance financial oversight and efficiency. Accounting software, financial dashboards, and cash flow forecasting tools offer real-time visibility, automate processes, and support better decision-making.

Q4. How do seasonal variations affect cash flow, and how can businesses manage them?

Seasonal variations can impact cash flow by causing fluctuations in revenue and expenses. Businesses can manage these variations by analyzing historical cash flow data, building cash reserves during peak periods, and implementing cost-saving measures during slower periods to maintain consistent financial stability.

Conclusion

The impact of cash flow on financial stability is profound and far-reaching. Effective cash flow management is essential for maintaining liquidity, supporting growth, and ensuring long-term financial health.

By understanding the relationship between cash flow and financial performance, and by implementing strategies to optimize cash flow, businesses can navigate financial challenges and achieve stability. As financial landscapes evolve, staying informed about cash flow trends and adopting best practices will remain crucial for sustaining success and achieving financial stability.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.