Manage cash flow during an economic downturn is vital for any business. It requires a strategic approach to navigate the challenges and uncertainties that come with such periods. Whether it’s a global recession or an industry-specific downturn, understanding how to manage cash flow effectively can mean the difference between survival and failure.This article explores various strategies and answers key questions to help you protect and manage your cash flow during tough economic times.

How Can We Protect Cash Flow During a Recession?

The key to protecting cash flow during a recession lies in careful planning and prudent financial management. One of the first steps is to create a detailed cash flow forecast. This forecast should outline your expected income and expenses over the next several months. By doing so, you can identify any potential shortfalls and address them before they become critical.

Another crucial step is to reduce unnecessary expenses. It’s essential to differentiate between needs and wants, focusing on essential costs that contribute directly to revenue generation.

The company should also consider negotiating with suppliers for better payment terms to ease short-term cash flow pressures. Finally, building a cash reserve can provide a financial cushion to weather the downturn.

How to Manage a Cash Flow Crisis?

When a cash flow crisis arises, swift and decisive action is necessary to prevent long-term damage to your business. The first step is to identify the cause of the crisis. Is it due to a sudden drop in sales, an increase in expenses, or delayed payments from customers? Understanding the root cause allows you to address it effectively.

Next, prioritize your payments. Focus on paying critical expenses like payroll, rent, and essential suppliers first. It’s also wise to reach out to creditors and negotiate extended payment terms.

Communication is key in a crisis; keeping your stakeholders informed can build trust and prevent further complications. Consider short-term financing options like lines of credit to bridge temporary gaps in cash flow.

Why Is Cash Flow Management Important During an Economic Downturn?

Cash flow management is the lifeline of any business, especially during an economic downturn. During these periods, businesses often face decreased revenue, delayed payments, and increased uncertainty. Proper cash flow management helps ensure that a company can meet its financial obligations, maintain operations, and avoid insolvency.

It also provides the flexibility to respond to opportunities that may arise during a downturn, such as acquiring assets at lower prices or expanding market share.

A well-managed cash flow allows businesses to navigate the challenges of a downturn with resilience, minimizing the risk of bankruptcy and ensuring long-term sustainability.

How Do You Manage Negative Cash Flow?

Managing negative cash flow requires a proactive approach. The first step is to conduct a thorough analysis of your cash inflows and outflows. This analysis can reveal areas where costs can be reduced or where revenue can be increased.

Cutting non-essential expenses is a crucial part of managing negative cash flow. It’s also essential to focus on improving collections from customers. Offering discounts for early payments or implementing stricter credit terms can help speed up cash inflows.

Businesses should consider diversifying their revenue streams to reduce reliance on a single source of income. If negative cash flow persists, seeking professional financial advice may be necessary to develop a more sustainable long-term strategy.

Enhancing Revenue Streams in a Downturn

The downturn can present opportunities to enhance and diversify revenue streams. One way to do this is by exploring new markets or customer segments that may not be as affected by the downturn.

For instance, if your business primarily serves the luxury market, consider introducing more affordable options to attract cost-conscious consumers. Another strategy is to expand your product or service offerings to meet changing customer needs during a recession.

This might include offering complementary products, subscription services, or digital solutions. By staying adaptable and responsive to market shifts, businesses can create new revenue streams that support cash flow during difficult times.

Cost Control Strategies to Boost Cash Flow

Effective cost control is a fundamental strategy to boost cash flow during a downturn. Begin by conducting a comprehensive review of your expenses to identify areas where costs can be reduced without compromising the quality of your products or services.

Effective cost control is a fundamental strategy to boost cash flow during a downturn. Begin by conducting a comprehensive review of your expenses to identify areas where costs can be reduced without compromising the quality of your products or services.

This may involve renegotiating contracts with suppliers, consolidating operations, or automating processes to reduce labor costs.Consider implementing lean management practices that focus on maximizing value minimizing waste.

It’s also important to involve employees in cost-saving initiatives, as they may have insights into areas where efficiency can be improved. By actively controlling costs, businesses can free up cash to reinvest in critical areas or build reserves for future uncertainties.

Maintaining Customer Relationships During Economic Hardship

During a downturn, maintaining strong customer relationships is crucial for sustaining cash flow. The focus should be on providing value and supporting your customers through tough times. This might involve offering flexible payment options, discounts, or loyalty rewards to encourage repeat business.

Communication is key, keeping customers informed about your business and how you’re adapting to the downturn can build trust and loyalty. Personalized customer service and outreach efforts can also strengthen relationships and create opportunities for upselling or cross-selling. By nurturing your customer base, businesses can maintain steady revenue streams, even when overall market conditions are challenging.

Leveraging Technology for Cash Flow Management

Technology can play a significant role in managing cash flow during a downturn. Utilizing financial management software can help businesses track income, expenses, and cash flow in real time, providing valuable insights that inform decision-making.

Technology can play a significant role in managing cash flow during a downturn. Utilizing financial management software can help businesses track income, expenses, and cash flow in real time, providing valuable insights that inform decision-making.

Automating invoicing and payment collection processes can also accelerate cash inflows and reduce the risk of late payments. Technology can assist in identifying cost-saving opportunities, such as energy-efficient solutions or process automation.

Investing in digital marketing can also be a cost-effective way to reach new customers and boost sales. By leveraging technology, businesses can improve their cash flow management and gain a competitive edge in a challenging economic environment.

The Role of Credit Management in Protecting Cash Flow

Credit management is a vital component of cash flow protection during a downturn. Poor credit management can lead to significant cash flow problems, as unpaid invoices and late payments can quickly accumulate. To protect cash flow, businesses should implement clear credit policies and enforce them consistently.

This includes conducting credit checks on new customers, setting appropriate credit limits, and monitoring payment behavior. Offering incentives for early payments or charging interest on late payments can also encourage timely settlements.

Maintaining open communication with customers and addressing payment issues early can prevent disputes and keep cash flow healthy.

Adapting Your Business Model to Sustain Cash Flow

Economic downturns often require businesses to adapt their models to sustain cash flow. This might involve shifting from a traditional sales model to a subscription-based or pay-as-you-go model, which provides a more predictable and steady stream of income.

Businesses may also need to adjust their pricing strategies to remain competitive and maintain profitability. Flexibility is key; companies that can pivot quickly to meet changing market demands are more likely to maintain cash flow during a downturn.

For example, if consumer demand shifts towards online shopping, businesses should invest in e-commerce solutions to capture this market. Adapting the business model not only sustains cash flow but also positions the company for growth when the economy recovers.

The Importance of Building Cash Reserves

Building cash reserves is one of the most effective ways to manage cash flow during a downturn. Having a reserve allows businesses to cover short-term expenses and unexpected costs without relying on credit or other external financing.

To build cash reserves, businesses should prioritize saving a portion of their profits during profitable periods. It’s also important to regularly review and adjust the reserve to ensure it remains sufficient for covering potential downturns.

A well-maintained cash reserve provides a safety net that enables businesses to continue operations and invest in opportunities even during challenging times. This proactive approach to cash management is essential for long-term stability.

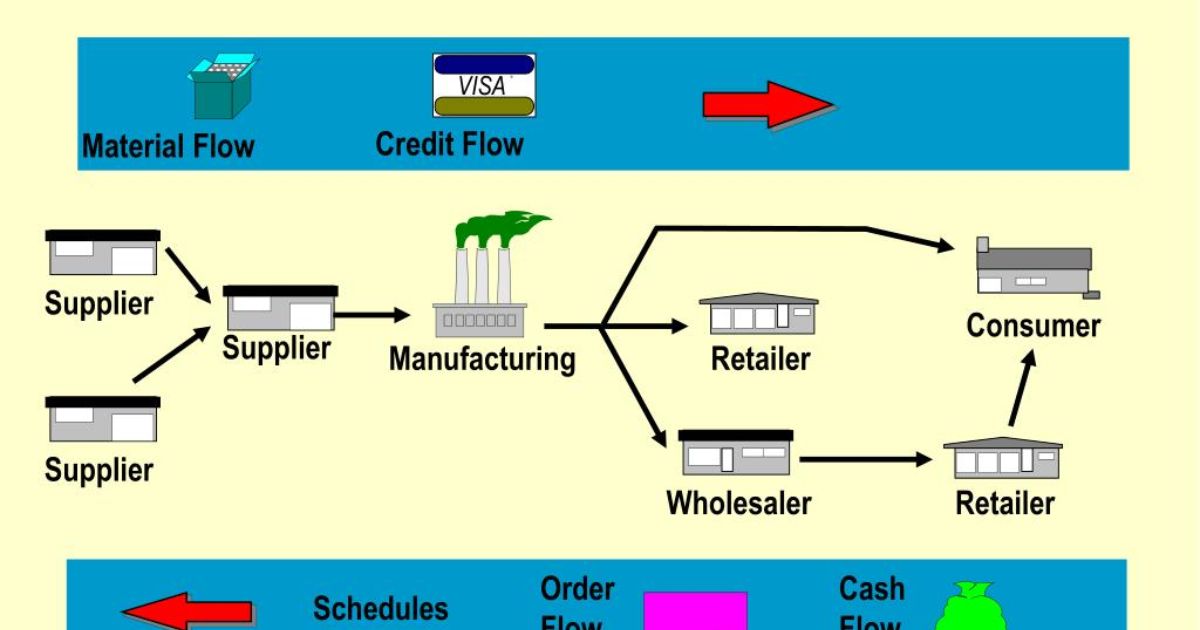

Managing Cash Flow in the Supply Chain

The supply chain can have a significant impact on cash flow during a downturn. Disruptions or delays in the supply chain can lead to increased costs and reduced revenue. To manage cash flow effectively, businesses should work closely with their suppliers to ensure consistent and timely delivery of goods and services.

The supply chain can have a significant impact on cash flow during a downturn. Disruptions or delays in the supply chain can lead to increased costs and reduced revenue. To manage cash flow effectively, businesses should work closely with their suppliers to ensure consistent and timely delivery of goods and services.

Negotiating favorable payment terms and bulk purchase discounts can also improve cash flow. Businesses should consider diversifying their supplier base to reduce dependence on any single supplier.

By maintaining strong supplier relationships and implementing strategic procurement practices, businesses can mitigate supply chain risks and protect their cash flow during a downturn.

The Role of Government Assistance in Cash Flow Management

During an economic downturn, government assistance programs can provide much-needed relief for businesses struggling with cash flow. These programs may include grants, low-interest loans, tax relief, or wage subsidies.

It’s essential for businesses to stay informed about the various assistance programs available and apply for those that align with their needs. Government assistance can help businesses cover essential expenses, maintain payroll, and invest in critical areas to sustain operations.

It’s important to use these funds wisely, focusing on areas that will have the greatest impact on cash flow and long-term sustainability. By taking advantage of government support, businesses can enhance their cash flow management during tough economic times.

Strategies for Maintaining Liquidity During a Downturn

Liquidity is a key concern for businesses during a downturn, as it determines the company’s ability to meet short-term obligations. To maintain liquidity, businesses should focus on accelerating cash inflows and delaying cash outflows where possible.

This might involve offering early payment discounts to customers, negotiating extended payment terms with suppliers, and reducing inventory levels to free up cash.Businesses should review their investment strategies and prioritize investments that generate immediate returns or enhance cash flow.

Maintaining liquidity requires careful monitoring of financial metrics and the flexibility to make adjustments as needed. By staying vigilant and proactive, businesses can preserve liquidity and navigate the downturn more effectively.

Planning for Recovery After a Downturn

Planning for recovery should begin even before the downturn ends. Businesses that prepare for recovery are better positioned to capitalize on opportunities as the economy improves.

This involves reviewing your cash flow management strategies and making adjustments to support growth. As market conditions stabilize, businesses should focus on rebuilding their cash reserves, investing in innovation, and expanding their market reach.

It’s also important to continue monitoring economic indicators and adjusting your business strategy accordingly. By planning for recovery, businesses can emerge from the downturn stronger and more resilient, with a solid cash flow foundation to support future success.

Frequently Asked Questions

1. What is the first step in managing cash flow during a downturn?

The first step is to create a detailed cash flow forecast. This allows businesses to anticipate potential shortfalls and address them proactively by identifying essential expenses and revenue-generating activities.

2. How can technology help in managing cash flow during tough times?

Technology can streamline financial management through automation, real-time tracking of income and expenses, and improved invoicing and payment collection processes. It helps businesses make informed decisions to protect cash flow.

3. What role do government assistance programs play in supporting cash flow during a recession?

Government assistance programs, such as grants, loans, and tax relief, can provide financial support for businesses struggling with cash flow. These programs help cover essential expenses and sustain operations during challenging periods.

4. Why is it essential to build cash reserves during profitable periods?

Building cash reserves provides a financial cushion during downturns, allowing businesses to cover short-term expenses without relying on external financing. It enhances long-term stability and supports continuous operations.

Conclusion

Managing cash flow during a downturn requires careful planning, proactive strategies, and adaptability. By protecting cash flow, managing crises effectively, and focusing on maintaining liquidity, businesses can navigate economic challenges with resilience.

Leveraging technology, building cash reserves, and taking advantage of government assistance programs are key strategies that contribute to long-term financial health. Through a combination of prudent financial management and strategic adaptability, businesses can not only survive a downturn but also position themselves for future growth and success when the economy recovers.

Meta

Learn effective strategies for managing cash flow during a downturn. Discover tips on protecting cash flow, handling crises, and improving liquidity for business success.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.