My Cash flow is the lifeblood of any business. Maintaining a healthy cash flow allows you to meet obligations, seize growth opportunities, and maintain stability during economic fluctuations.

The key to improving my cash flow lies in understanding the fundamentals and taking actionable steps to address any issues. The following guide provides strategies that can help to manage and boost my cash flow, ensuring your business stays financially strong.

How Can I Increase My Cash Flow?

The first step to increasing cash flow is to monitor your income and expenses closely. The most effective way to do this is by creating a detailed cash flow forecast that identifies when money is coming in and going out. The forecast can help you make informed decisions about your finances. It also enables you to plan for seasonal fluctuations and avoid shortfalls.

It’s also important to diversify your revenue streams. Relying on a single income source can be risky. Consider expanding your product or service offerings, exploring new markets, or creating additional revenue channels. Another tactic is to offer early payment discounts to encourage customers to pay faster. You could also implement subscription models or recurring billing to ensure a steady flow of income.

How Do You Overcome Poor Cash Flow?

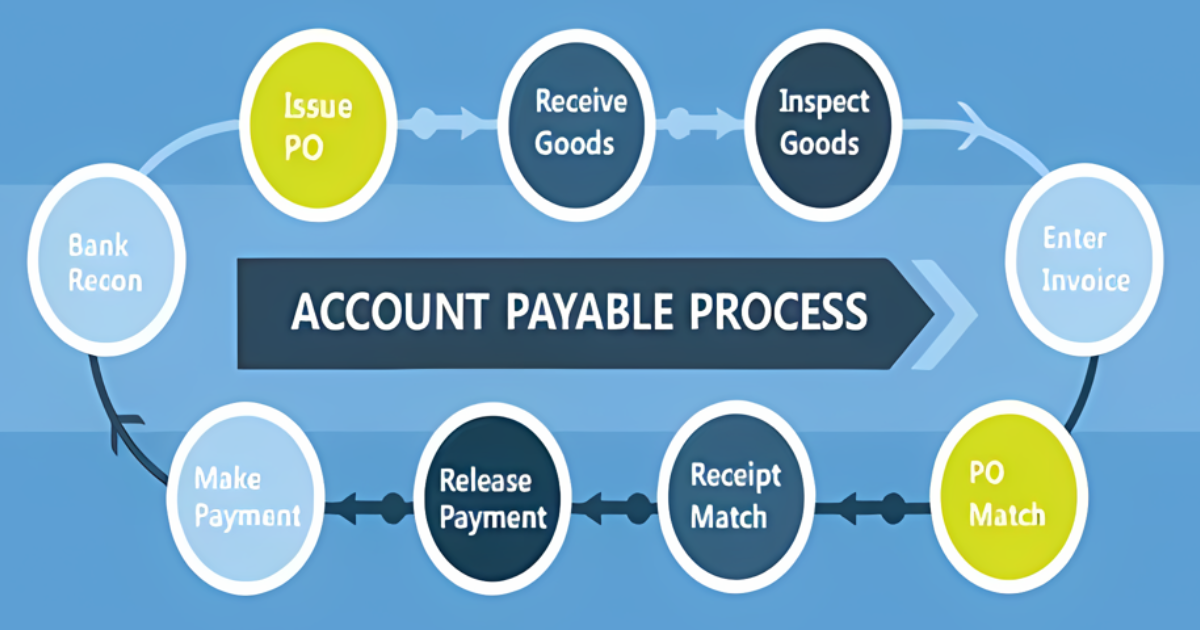

To overcome poor cash flow, you need to identify the root cause of the problem. The issue could stem from late payments, high expenses, or mismanagement of funds. Start by revisiting your accounts receivable process.

Streamline invoicing, send reminders, and enforce stricter payment terms to ensure customers pay on time. You might also want to negotiate with vendors for longer payment terms, which will give you more time to pay your bills without affecting your cash flow.

It’s also vital to cut unnecessary costs. Regularly review your expenses and look for areas where you can reduce spending. Negotiate better terms with suppliers or explore more cost-effective alternatives. Consider liquidating underperforming assets or selling off obsolete inventory to generate quick cash.

What Increases Cash in Cash Flow?

Increasing cash in cash flow requires a mix of revenue generation and efficient expense management. One effective strategy is to optimize your inventory. Holding too much stock ties up cash that could be used elsewhere. By managing inventory more efficiently, you can reduce holding costs and free up cash. Similarly, improving your sales process can help convert leads into paying customers faster, bringing more cash into the business.

Another way to increase cash flow is by leveraging credit wisely. For example, using business credit cards for expenses can help you maintain cash reserves while earning rewards. Just ensure that you manage credit carefully to avoid high-interest costs. You can explore invoice factoring, where you sell your unpaid invoices to a third party at a discount. This gives you immediate cash flow, albeit at a reduced margin.

What Are the Three Main Causes of Cash Flow Problems?

Cash flow problems often arise due to several factors. The three main causes are:

- Late Payments

- When customers delay paying invoices, it disrupts your cash flow. Late payments can prevent you from meeting your own financial obligations, leading to a cycle of debt.

- Overstocking

- Holding excess inventory can tie up cash that could be used for other purposes. Managing inventory efficiently is key to preventing cash flow problems.

- High Operating Expenses

- If your expenses are too high, they can quickly outstrip your revenue, leading to cash flow problems. It’s essential to monitor your expenses closely and make necessary adjustments to maintain a balance.

The Importance of Regular Cash Flow Monitoring

Regular cash flow monitoring is crucial to avoid potential financial crises. It enables you to spot trends, anticipate problems, and adjust your strategies accordingly. Businesses should conduct cash flow analyses on a monthly or quarterly basis, depending on the nature of their operations. This will help you maintain a proactive approach to managing your finances, rather than reacting to problems after they occur.

By keeping a close eye on your cash flow, you can identify inefficiencies and address them before they become major issues. For example, if you notice a trend of late payments, you can implement stricter invoicing procedures to mitigate the impact on your cash flow.

Diversifying Revenue Streams

One of the most effective ways to improve cash flow is by diversifying your revenue streams. Relying on a single income source leaves your business vulnerable to market changes. Consider expanding your product or service offerings to reach new customers. You could also explore new markets, such as international sales, or create subscription-based services that provide a steady stream of income.

It’s also important to explore partnerships and collaborations that can open up new revenue opportunities. By working with other businesses, you can share resources and reach a broader audience, which can lead to increased sales and improved cash flow.

Managing Inventory for Better Cash Flow

Inventory management is a critical aspect of cash flow management. Holding too much stock can tie up your cash, while holding too little can result in missed sales opportunities. The key is to find the right balance between having enough inventory to meet demand without overstocking.

Consider using inventory management software to track stock levels and optimize your purchasing decisions. By maintaining the right amount of inventory, you can reduce holding costs and free up cash that can be used for other business needs.

The Role of Credit in Cash Flow Management

Credit can be a valuable tool for managing cash flow, but it must be used wisely. Business credit cards, lines of credit, and loans can provide the necessary funds to cover short-term expenses or invest in growth opportunities. It’s important to avoid over-reliance on credit, as high-interest rates can eat into your profits and exacerbate cash flow problems.

When using credit, be sure to have a clear repayment plan in place. Use credit to cover expenses that you can pay off within a reasonable time frame, and avoid using it for discretionary spending. By managing credit responsibly, you can improve your cash flow without putting your business at risk.

Negotiating with Suppliers for Better Cash Flow

Negotiating with suppliers can have a significant impact on your cash flow. By securing better payment terms, you can extend the time you have to pay your bills, which can help alleviate cash flow pressures. You can negotiate for bulk discounts or other cost-saving measures that can improve your profit margins and cash flow.

Building strong relationships with your suppliers can also lead to more flexible payment terms. For example, if you’re experiencing a temporary cash flow crunch, your supplier may be willing to extend your payment deadline or offer a payment plan.

Improving Your Accounts Receivable Process

Your accounts receivable process plays a crucial role in maintaining healthy cash flow. Streamlining invoicing and payment processes can help ensure that you receive payments on time. Consider offering early payment discounts to incentivize customers to pay their invoices promptly. Sending regular payment reminders can help reduce late payments.

It’s also important to establish clear payment terms from the outset and enforce them consistently. If a customer is consistently late with payments, you may need to reconsider your business relationship with them or adjust your terms to protect your cash flow.

Cutting Unnecessary Costs

One of the simplest ways to improve my cash flow is by cutting unnecessary costs. Regularly review your expenses and identify areas where you can reduce spending. This could include renegotiating contracts, switching to more cost-effective suppliers, or eliminating services that are no longer necessary.

It’s also important to evaluate your staffing levels and ensure that you’re not overstaffed. While it’s important to have enough employees to meet demand, overstaffing can lead to unnecessary payroll costs that can strain your cash flow.

Liquidating Underperforming Assets

If your business is holding onto underperforming assets, it may be time to liquidate them to free up cash. This could include selling off outdated equipment, excess inventory, or real estate that is no longer serving your business needs. By converting these assets into cash, you can improve your cash flow and reinvest in areas of the business that will generate higher returns.

It’s important to regularly review your asset portfolio and identify any assets that are not contributing to your business’s success. By liquidating these assets, you can improve your cash flow and focus on growing your business.

Exploring Alternative Financing Options

If you’re struggling with cash flow, exploring alternative financing options may be necessary. This could include factoring, where you sell your invoices to a third party for immediate cash, or merchant cash advances, where you receive a lump sum of cash in exchange for a percentage of future sales.

Crowdfunding, peer-to-peer lending, and venture capital are other options to consider. These alternative financing methods can provide the funds you need to improve your cash flow without taking on traditional debt.

Maintaining a Cash Flow Reserve

Maintaining a cash flow reserve is one of the most effective ways to protect your business from unexpected financial challenges. A cash flow reserve acts as a financial cushion that can help you cover expenses during periods of low revenue or unexpected costs.

The size of my cash flow reserve will depend on your business’s needs and the level of risk you’re willing to take on. Ideally, you should aim to have enough cash reserves to cover at least three to six months of operating expenses.

Frequently Asked Questions

Q1. How can I improve my cash flow in the short term?

In the short term, you can improve your cash flow by accelerating receivables, negotiating extended payment terms with suppliers, reducing expenses, and liquidating underperforming assets.

Q2. What are some common mistakes that can lead to cash flow problems?

Common mistakes include not monitoring cash flow regularly, overstocking inventory, failing to collect receivables promptly, and over-reliance on credit.

Q3. How can I forecast my cash flow effectively?

To forecast your cash flow, start by tracking all your income and expenses. Use historical data to predict future cash inflows and outflows, and create a detailed cash flow statement to guide your financial decisions.

Q4. What role does credit play in cash flow management?

Credit can provide a temporary boost to cash flow, but it must be used wisely. Mismanagement of credit can lead to high-interest costs, which can strain your cash flow in the long term.

Conclusion

Improving my cash flow is essential to ensuring the long-term success and sustainability of your business. By regularly monitoring your cash flow, diversifying your revenue streams, managing inventory efficiently, and negotiating with suppliers. You can maintain a healthy cash flow and avoid financial difficulties.

Cutting unnecessary costs, leveraging credit wisely, and maintaining my cash flow reserve can provide you with the financial flexibility you need to weather any challenges that come your way. Staying proactive and implementing these strategies will not only improve your cash flow but also position your business for future growth and success.

Milton is a seasoned financial strategist who shares expert insights and practical tips on mastering cash flow to help you achieve financial stability and growth.